Letters to the Editor: June 23, 2022

Returned Coins Create Funds for More Collecting I blamed my coin hoarding of pocket change on the book, Strike It Rich. I now have finally gone through all that change,…

Returned Coins Create Funds for More Collecting

I blamed my coin hoarding of pocket change on the book, Strike It Rich. I now have finally gone through all that change, and I am rich.

I recently took my coin hoarding lot to my local bank for counting and deposit. I now have an extra $525.50 to spend on more collectible coins. I did my part to re-circulate pocket change and got rich doing it.

Richard Stevenson

Lexington, Tenn.

Gold Market Prices Collector Out of $1 Pursuit

I read with interest the Indian Princess Head gold U.S. $1 article in the May 22 issue of NN by Mark Benvenuto. But my experience with that series makes me think his sources or information are a bit dated. Nowadays those little gold coins command hefty prices, even for those that were turned into love tokens or other jewelry over a century ago.

My silver coin collecting having rather topped out, I decided a couple of years back that it might be fun to start a gold $1 collection simply by date. (My budget would never allow me to capture the rare dates, including the Dahlonega- or Charlotte-minted coins.) So for once, I did the right thing and “read the book first.” I purchased the 2011 publication by Q. David Bowers, A Guide Book of Gold Dollars.

Bowers book suggests that there never was much demand for the dainty little gold dollars, and nearing the end years of their mintage, jewelers and a few collectors were about the only demand. So I jumped into buying the ones I could afford – no proofs or BU coins. I bought my first couple of VF Indian Princess gold dollars (1888 and 1889) in early May 2018. I was pleased enough with the price and quality, and proceeded to capture a double handful of other dates. Bowers’ book even suggested that the elusive 1884 and 1886 were out there and plentiful enough to be had. (Though I never found them affordable).

Then the pandemic hit and gold bullion skyrocketed. I watched all the little gold dollars go up, up and up in price. I purchased my last gold Indian Princess $1 in January of 2020. Since that time, I have felt priced out of the market. Even what I would term damaged, soldered or near cull pieces are high priced. The up-tick in bullion seems to have given some sellers reason enough to tack on some extra margin on the better dates. If gold prices ever get back to 2018 levels, I may try my luck again – for now, I will try silver dimes.

David Smith

Tennessee

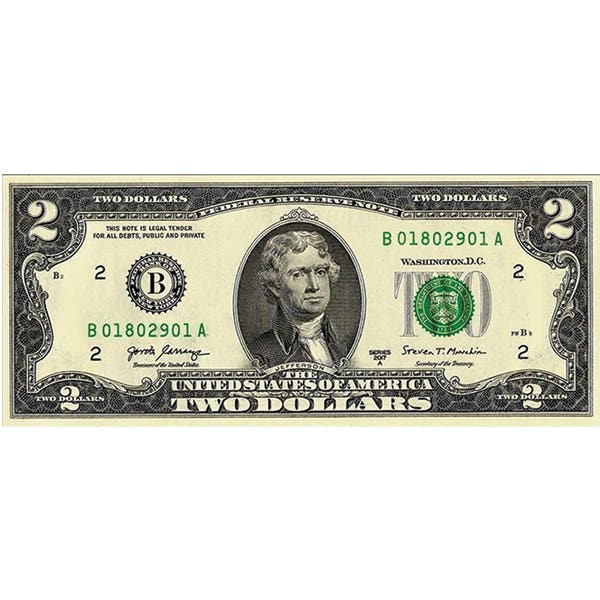

Mints Will Cease to Produce Non-Bullion Coins

One day the government is going to wake up and reduce the mints to coining bullion coins. The value of all the rest of coins is almost nil. Having watched what was done to replace the pfennig and franc coins, one only wonders why bother minting valueless coinage? The progressives in this country want control of every transaction made in this country. Cryptocurrency, Bitcoin and any other Ponzi scheme to take the place of the dollar will hasten the non-bullion coin to its death. Yes, collectors will always be around as well as bullion coins. The purchasing power of the dollar may soon cease to exist. Then what? Use a debit/credit card for everything? More likely than the mints continuing to produce worthless coins. Only us collectors will be interested, and I guarantee you there are less and less. Wait till us Boomers are gone in the next 10-15 years. I will be proved.

Tommy Westmoreland

Address withheld

Show Admission Fee Trend is Concerning

I have noticed over the past year or so that small to mid-size coin shows are now charging an admission fee. Seems to be trending mainly on the coasts.

I noticed a particular show was charging $3 admission for a show featuring 30 tables. They were also charging their dealers $135 table. I see many similar examples.

Might I suggest you find a different venue for your shows? Many VFWs and American Legions are happy to work a great rate on a hall in the hopes of pulling in new customers.

These admission fees are a troubling trend. It will drive away much more business than the relatively small revenue it produces.

Don’t be short-sighted.

John Quarfoth

Blaine, Minn.

Coin Clinic Information on PNG Outdated

Leaders of the Professional Numismatists Guild, a nonprofit organization composed of many of the country’s top rare coin and bank note experts, are surprised and disappointed that Numismatic News would use old, outdated information regarding PNG’s opinion about grading services. The Coin Clinic column response to a reader’s question in the May 31, 2022, edition of Numismatic News cited a survey of PNG member-dealers conducted way back in 2007.

The marketplace has significantly changed in 15 years. The official grading service of the PNG is Numismatic Guaranty Company (NGC). As an organization, the PNG does not rank, nor does it have any affiliation with other grading companies. Buyers and sellers of numismatic items who have questions about grading and grading services should speak directly with any of the reputable, knowledgeable members of the Professional Numismatists Guild. A list of PNG member-dealers can be found at www.PNGdealers.org.

Robert Brueggeman

Executive Director

Professional Numismatists Guild