Starck Reality: Metal prices may lead to mass melting of common silver coins

Record silver prices are driving discounts, melting decisions, and tough choices for collectors of common world coins.

For the last few decades, silver stackers and gold bugs have been preaching the imminent breakout of their respective metals, suggesting that gold could top $2,000, then $2,500, and so on, for an ounce. Those who took a shine to silver have suggested that $50 and even $100 an ounce was possible. A select few have even proclaimed higher benchmarks. For all the times those passionate defenders wound up crying wolf, but now the wolves are at the door.

But the effect this has on world coin pricing, aside from pushing the underlying base value higher, remains unclear. The high prices may already have priced some collectors out of the market. And some folks are cashing in their newfound wealth by sending common coins to be melted, though they aren’t reaping the full rewards of the increased melt value. The only thing slowing down the mass melting of common world coins is the massive backlog at refineries. The demand that started in the fall, as silver breached the $50 high-water marks of 2011 and 1979–1980, has not abated.

With refineries months behind in processing silver, many coin shops buying silver coins, especially world coins, over the counter have adjusted their offers. They are pricing in the risk that the spot value will drop between the time the silver can be sent to a refinery and payment terms are locked in. In my local experience (St. Louis), dealers have discounted the value of sterling silver products by 20%, meaning they’re offering about 80% of the “melt” value at the time of the transaction.

At the time of this writing, silver sits above $80 an ounce in intraday trading. Coins with even lower fineness are seeing more aggressive discounts to account for the increased work to remove the non-silver metal from the alloy.

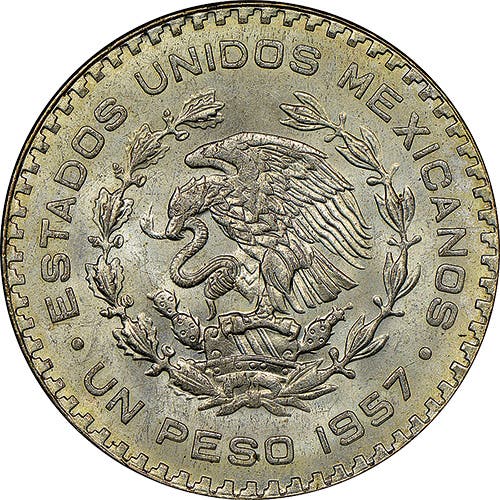

A 20th-century favorite for collectors is the Mexican 1 peso from 1957 to 1967, struck from 10% (.100 fine) silver. Whereas these coins were as cheap as $1.25 years ago, their price has risen in step. A local shop that had them for $2.50 as recently as December 2025 now sells them for $3.50.

At some point, I expect that a stable market price and normal refining capacity will push millions of dollars’ worth of worn and lower-grade common-world silver coins into melting pots.

Jeff Starck can be reached at jstarck@aimmedia.com

You may also like:

Jeff Starck is the Market Analyst for Numismaster.com and is a lifelong collector and writer. His appreciation for and interest in world coins and writing allows him to share the hobby with others.