Silver Ingots in a Tight Market

Today’s silver market may fluctuate, but ingots endure as collectible works of art shaped by private mints and creative ambition.

Silver!

That brilliant, shiny, lustrous, white, precious metal, used in coins and jewelry for thousands of years, is once again making headlines for its soaring prices. This stunning and malleable chemical element is now at its highest value per ounce in history. Silver (Ag), with its atomic number of 47, meaning it has 47 protons in its nucleus, is considered to be a relatively rare element here on Earth. It is much less common than copper or iron, but about 19 times more abundant than gold. Silver is about 75 parts per billion in the Earth’s crust and is often found while mining other metals such as copper, lead, and zinc. Locating large, pure deposits of this gorgeous metal is very rare.

As I sat down to write my next article for Numismatic News, I saw on a news blurb that silver was trading at $63.90 an ounce! (At time of publishing, silver has risen to $107.65) This intrigued me incredibly, as it was at its highest point I have ever seen, and it was really incredible news. I placed my little dog, Daisy, an adopted 4.7-pound Yorkie, next to me in a chair with her pink bed and fluffy blanket, as she keeps me company when I write and keeps her out of trouble. As I pondered what to write about for my next piece, I abruptly changed my mind because of that news flash I saw on my iPad. Studying coins and precious metals nearly all my life, I had, somewhere in the back of my mind, remembered that silver was nicknamed the “devil’s metal”. This is due to its extreme price volatility, with unpredictable price swings that can change rapidly. Silver’s price swings up or down much faster than gold or platinum, leading to significant losses and extreme gains depending on when you buy or sell. Another obscure reason silver receives that unflattering name is that miners have encountered cobalt ore, often near silver, which stained their skin black and was associated with demons, leading to the “demon metal” idea, which got linked to silver.

All of this got me thinking about silver, or more precisely, about what happened with silver in the 1980s. I was just about 23 years old when the big silver rush took place, the one that changed the market and how we viewed silver. This was a time when you could actually find older silver coins in change, or go through rolls of bank coins, and, if you were lucky, pluck out a few great silver pieces. I thought about how silver prices soared from just under $6 in early 1979 to an astonishing nearly $50 in January 1980. The mathematics tells you that there was an increase of over 800 percent. That was the most significant increase that I have ever experienced in my life, so far. I was especially intrigued, as I had purchased 50 ounces of silver bars from the Hamilton Mint between 1974 and 1976 at $4.95 each. It was a set commemorating each of the 50 states, issued in pairs until you had them all. They also gave you a beautiful hardwood box lined with felt to display this collection when you completed this series of ingots. They finished off this collection by sending you a brass plate engraved with your name. You can only imagine how thrilled I was to know my bars increased tenfold over 4 years after I assembled that incredible set. Fifty years later, I can still admire these 1oz works of art, as I still have this set in my possession today.

So, just what caused this massive price explosion named “The Silver Surge of the 80s”? How in the world did this happen? Who caused this unprecedented and out-of-control situation? Folks my age who were collectors and investors, and perhaps many others who were around at the time, should recall what happened, as it was considered “big news”.

Silver was already on the rise before 1980, and coin collectors like me wanted to obtain as much as they could find or afford. Collectible silver bars, such as those from Engelhard and Johnson Matthey, were bought and sold in the mid-1960s, mainly as a hedge against inflation. Then some companies began incorporating interesting designs into their ingots. Popularity grew moderately until about 1970, and then much more rapidly until the late 70s. These ingots became increasingly popular, and in 1979, the “Hunt Brothers,” Nelson Bunker Hunt and William Herbert Hunt, began buying vast amounts of physical silver and silver futures. These two brothers, who were originally oil magnates, aimed to control the market and profit from rising prices, and eventually held an estimated one-third of the world’s non-government silver supply. High inflation and economic uncertainty drove many investors to buy precious metals, including silver, further fueling demand. Silver prices soared to a questionable nearly $50 an ounce. Precious metal dealers, coin collectors, and investors were in a frenzy to buy and sell silver.

It seemed everyone wanted to get into selling silver bars and ingots, and many companies entered the market, besides Engelhard and Johnson Matthey (JM), the top producers. Other companies produced silver bars like the Canadian Mint, Sunshine Minting, U.S. Assay Office, and PAMP Suisse, which manufactured bars in various sizes to be sold and traded for melt value. The Shields Mint, a minor operation, came into existence during this time and was known for low-mintage “Art Bars,” which sparked a new market that became very popular with collectors.

More and more companies and mints began producing silver art bars in various sizes and shapes, with themes spanning almost every imaginable subject. Mints such as the Franklin Mint, Hamilton Mint, Perth Mint, Scottsdale Mint, SilverTowne, and Germanic Mint all got into the act, mainly producing (.999 fine silver) all for investing and collecting. It was basically a win-win for all the mints involved, as everyone wanted to hold some silver and something interesting to collect. I recall that the coin magazines of the day often had as many, or possibly more, ads for silver bars as they did for coins! Colorful, beautiful ads graced the magazines every month with new, innovative, and exciting silver bar designs.

A delightful part of all of this is that some of these private mints and Refiners produce really wonderful and interesting pieces, often more interesting than “standard silver bars”, produced by the government. I believe this also began to force the Major Sovereign Mints (government-backed) to create more iconic and innovative pieces to compete with private mints, and they all needed to sell silver as quickly as possible.

Many (beautiful) silver bars, also known as ingots with interesting designs and themes, were being produced by many of the major brands that minted silver bars. Much of the craftsmanship featured “old world” styles, including molten silver poured into molds and struck bars with intricate designs. A few of these manufacturers hired top artisans from other mints to produce unique pieces and bars that they could (not allowed to) necessarily design while working for a government mint. This opened up an entirely new market and allowed these craftsmen to create almost anything they wanted, in the style they wanted.

Many themes emerged from all these different mints, and the possibilities seemed almost endless—some of the more interesting ones I have listed here.

Patriotic and Historical Themes:

Particularly in the mid-1970s, around the U.S. Bicentennial in 1976, the year I graduated high school, I saw a significant surge in ingots featuring patriotic designs. American Flags, Eagles, Yankee Doodle, States of the Union, and historical figures, as well as Presidential Seals, all graced these silver bars.

Commemorating Art Bars:

Holiday-themed bars were minted, and many were focused on artistic merit. Christmas, Thanksgiving, Halloween, and Mother’s and Father’s Day were incorporated into fun and interesting new bars.

Wildlife and Nature:

Many, many pieces, pictured wildlife, wilderness, and the wonders of nature. Animals from all over were engraved on pieces, often with intricate detail. Bobcats, beavers, and bears all had their places on countless pieces. The American Bald Eagle is one of the most classic designs found on many generic silver bars.

Cartoon Characters:

Many cartoon characters, such as Bugs Bunny, Daffy Duck, Mickey Mouse, Pinocchio, and others from Disney, are illustrated on classic silver bars, including a set of 12 bar enameled sets featuring characters like The Little Mermaid and The Lion King. Garfield, Popeye, Scooby-Doo, and the Hulk all appeared on bars and silver rounds from the 1970s to the 1980s, as well as Wonder Woman. Of course, Snoopy and Charlie Brown could not be left out, for the Peanuts gang were produced in both regular issues and colorized bars. Garfield and many other popular cartoon characters can also be seen on these pieces.

Trains, Plains, and Automobiles:

Many bars featured variations of old steam trains, period aircraft, and vintage automobiles, as well as newer and more modern vehicles like my favorite, the DeLorean. Cars like the Chevy, Corvette, and Nova SS graced the obverse of some of these silver pieces. The Franklin Mint issued a 100 mini-ingot set depicting classic cars such as the 1913 Mercer and the 1935 Bugatti. They were Sterling silver and are considered highly collectible.

Ships:

Old ships, warships, steamships, aircraft carriers, and new ships all appeared on many of the most popular silver bars and ingots of this era. Just like in coins, there were so many interesting and exciting designs, and too many to mention.

Presidents:

Many famous portraits of presidents were engraved on various-sized ingots, but Washington and Lincoln seemed to monopolize that category in the beginning. Later on, many other presidents and key American figures were depicted in designs.

Zodiac Themed Bars:

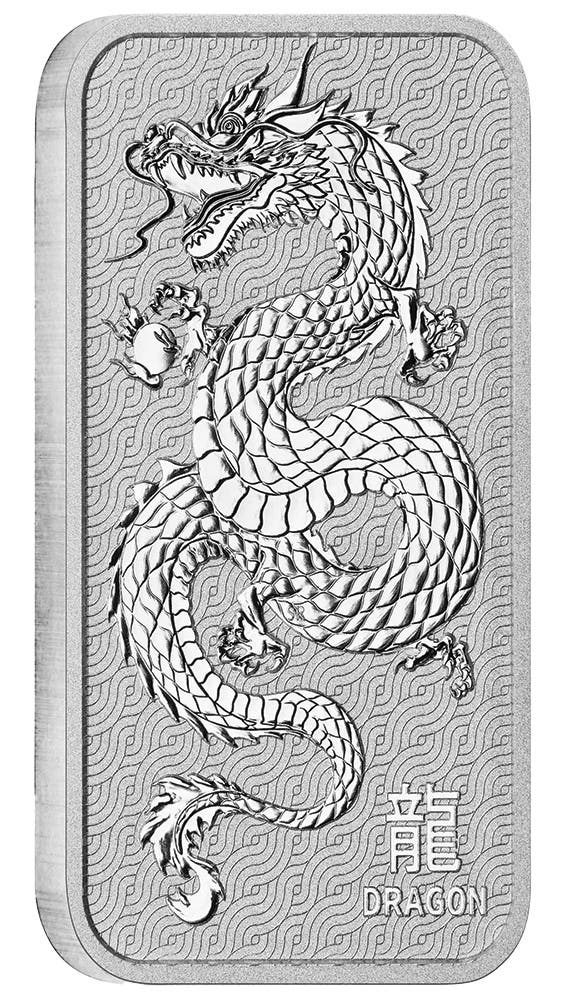

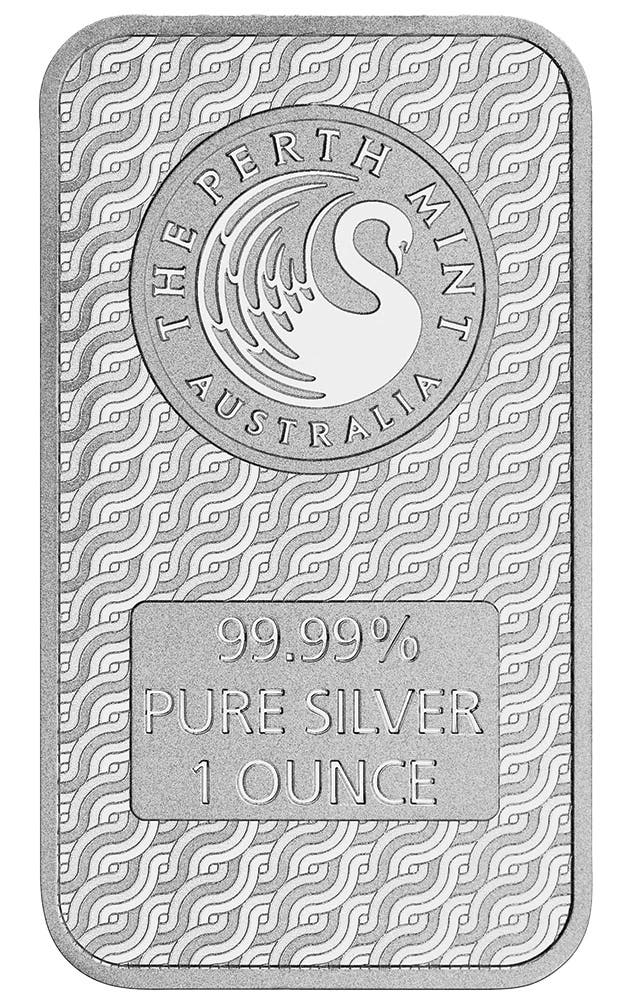

(Image courtesy The Perth Mint)

A popular silver bar was the Signs of the Zodiac, sometimes sold by sign or as an entire set. These were quite popular, with many different types and techniques used. Today, there are pieces with detailed holograms. All the lunar animals are featured on silver rounds and bars, like the Dragon, Snake, Tiger, and Rabbit.

Classic Purity and Weight Silver Bars:

Some manufacturers produced bars that stated their purity and weight. The most popular bar sizes were 1oz, 10oz, and 100oz, clearly stamped as .999 Silver or 999 Fine Silver to ensure you knew what you were actually buying. These bars remain as part of the mainstream for people investing in silver, but are not necessarily artistic or creative. Many bars like this are being produced today.

Moon Landing and Space Travel:

There are silver bars that commemorate events such as the Apollo Moon landings and the first man to orbit the Earth. Several mints produced Skylab-themed silver bars and medals to celebrate the United States first space station. Several silver bars feature Neil Armstrong and the Apollo 11 moon landing. Space theme pieces became very popular during that time.

Coins and Medals:

Silver bars have been featured in iconic images such as the Indian Head Penny, Buffalo Nickel, Morgan Silver Dollars, and Peace Dollars, as well as in modern coins like the Lincoln Penny.

Norman Rockwell:

Norman Rockwell’s Four Seasons was featured on a short series of square ingots by the Hamilton Mint, and they are very artistically rendered. Other bars feature Rockwell, many of which were produced by the Franklin Mint, and are in high demand today. They portrayed iconic scenes from “The Patient” and other Saturday Evening Post covers on exciting, well-designed pieces.

As you might imagine, many more interesting and exciting themes were featured on silver bars. Some, well, maybe not so much artistic as others, but as artists, we all know, beauty is in the eye of the beholder. If you are interested in this area of numismatics, and silver bars and rounds are a part of this wonderful field, there is a lot of information out there if you take the time and look. You could use the internet and websites explicitly dedicated to this topic.

In my opinion, as an artist, there are outstanding pieces available to collectors that showcase exquisite artistry on these pure silver works. Keep in mind, as I have stated before, I collect mainly because I like something, I enjoy the way it looks, I like the way it feels in my hand, and I appreciate the interesting and different artwork. I have never collected anything because I anticipated it would go up in value, or as an investment, although when that happens, it is a nice benefit.

A couple of pieces I really enjoy and think are outstanding engravings are “Una and the Lion” from the Sunshine Mint. The obverse design features Princess Una lovingly embracing the lion, a scene from British mythology. The bars come in 1 oz, 10 oz, and 100 oz. This limited series ingot is just magnificent to look at and admire. The details on this piece are magnificent.

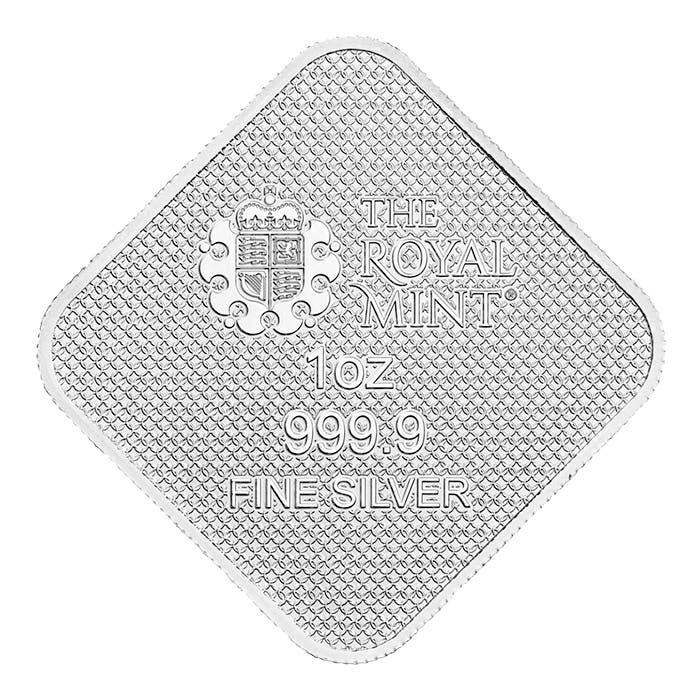

I also love the Queen’s Beast 1oz Silver Bar, produced by the Royal Mint. Part of the Queens Beasts series, it is square with rounded corners. The design portrays a young Queen Elizabeth II, encircled by the inscriptions “The Queen’s Beasts” and illustrated with related heraldic figures. This truly remarkable design is more than outstanding; it’s stunning.

Today, numerous pieces are still being produced and sold. With the rise of silver again, it’s no wonder that mints are getting back into the market. New silver ingots are being created in full color, with partially colored highlights, holograms, privy marks, and many other new features becoming increasingly available. Perhaps it’s time to look into collecting some of these pieces from years ago and today.

So, just what happened to the silver market of the 80s after that sudden uprising? Obviously, it did not stay at those dramatically high levels. The Texas oil tycoons, the Hunt Brothers, who attempted to corner the global silver market by buying massive amounts of physical silver and futures in silver, finally collapsed in what came to be known as “Silver Thursday”. They acquired so much silver that they had to charter many planes to transport it to a Swiss Vault. Obtaining all that silver wasn’t enough for them to satisfy their goal. As indicated above, they also bought large futures contracts, using their existing silver as collateral to secure more loans to buy even more silver. When regulators intervened and realized what was going on, the Commodity Exchange (COMEX) imposed new margin rules, restricting the Hunts’ ability to buy more on credit. When the brothers couldn’t meet their margin call, the price plummeted on March 27, 1980, causing the so-called “Silver Thursday”. The aftermath brought huge losses to the Hunts as their leveraging positions collapsed, and they lost 1.7 billion dollars. They were also ordered to pay 134 million dollars in compensation to a Peruvian mineral company, one of the largest such filings in Texas history. Many other investors lost vast sums of money, as silver was no longer worth nearly what they had paid for it. Silver that day fell from $49 an ounce to just under $11, causing wider financial chaos as their brokers faced margin calls. Both Nelson and William filed for bankruptcy in the late 1980s. Their scheme led to new market reforms, including significant changes to commodity market regulations. Most of those regulations are still in place today to ensure that the situation can never happen again. The price of silver fell to $3.46 per ounce in February 1991. It has been going up and down ever since, but has increased over the years to the level it is today.

With today’s silver market rising at astronomical levels, even at a faster rate than it did back in the 1970s and 1980s, I think people are really pumped up about it, or downright nervous about its eventuality. Could the silver market surge even higher than it is today? I am seeing predictions that it could hit $100-$200 an ounce or higher. Personally, I don’t think that is happening anytime soon. Could it possibly plunge way below its current levels, as it did back when the Hunt brothers settled for greed back in 1980? Could history repeat itself?

Besides silver being used for commemorative and special-issue coins worldwide, as well as in jewelry and silverware, it has become vital in electronics, solar energy, and medicine due to its conductivity and antimicrobial properties. It is a crucial component in smartphones, computers, televisions, and many other electronic gadgets. Silver is essential in photovoltaic cells for solar panels and in batteries for electric vehicles. It is also used for filtration systems to kill bacteria and viruses in Water Purification. This beautiful, shiny metal is used for coatings and mirrors because of its high reflectivity and is indispensable for its unique properties and malleability. Silver often does not get the glory that gold does, but it is considered one of the most useful precious metals on the planet. The use and demand for this material have been growing every day, and continue to increase exponentially.

With more and more silver being used each day at a rate never seen before and shrinking inventory worldwide, some analysts warn that visible stockpiles could reach critically low levels in under two years. With the uncontrolled frenzy surrounding this precious metal, governments worldwide are once again issuing new silver coins and series at an unprecedented rate.

On January 21, 2026, the price of silver was between $95 and $96 per troy ounce! That’s an increase of over $30 an ounce since I started writing this article over a month ago, on December 11.

So, where is the price of silver going to go? Can it reach $200 or higher by the end of the year? Can it reach $300 or more eventually? Will it get an incredibly high level before plummeting again like the Hunt Brothers’ days? No one actually knows for sure. What I do know, or rather what I believe, is that many things are different from what they were back in the 1970s and 1980s. No one is trying to “corner the market” and control the entire supply of silver. As stated, the use of silver is much greater than it was 45 years ago and is becoming increasingly scarcer.

As a numismatist, it will be exciting to follow this and see what happens. As an investor, buying and selling in this market could potentially make you a lot of money. Beware that you can also lose money, so pay close attention to the market and what’s happening, and be prepared to sell when you see fit. From a collector’s point of view, it would be a challenge and a great deal of fun to see what the governments of the world and private mints will produce in new silver coins, both mint state and proof, and obtain pieces that interest you.

You may also like:

Philip Lo Presti grew up on Long Island, New York, is retired, and now lives in Florida. His interest in coins was sparked by a Canadian coin he received in spare change at the ripe old age of 6. The different look of that coin spurred him on to study and collect coins for the next 61 years. His relationship with Numismatic News began with contributions to “Letters to the Editor” and the “Viewpoint” sections of the publication. His viewpoint critiquing the artistry of the newly released state quarter program attracted the attention of the editor at the time, who published it as a two-part feature series. He now enjoys writing articles regularly. He is a lifelong artist and photographer as well as a numismatist and brings his eye for artistry, beauty, and craftsmanship to his impressions and interpretations of coins. He combines these with a little bit of coin history to create interesting, informative, unique, and often witty articles. He loves and values the responses to his articles and hopes to hear from more readers in the future!

Philip Lo Presti grew up on Long Island, New York, is retired, and now lives in Florida. His interest in coins was sparked by a Canadian coin he received in spare change at the ripe old age of 6. The different look of that coin spurred him on to study and collect coins for the next 61 years. His relationship with Numismatic News began with contributions to “Letters to the Editor” and the “Viewpoint” sections of the publication. His viewpoint critiquing the artistry of the newly released state quarter program attracted the attention of the editor at the time, who published it as a two-part feature series. He now enjoys writing articles regularly. He is a lifelong artist and photographer as well as a numismatist and brings his eye for artistry, beauty, and craftsmanship to his impressions and interpretations of coins. He combines these with a little bit of coin history to create interesting, informative, unique, and often witty articles. He loves and values the responses to his articles and hopes to hear from more readers in the future!