Cash tight in bullion market

Although there were some spurts in retail demand over the past two months or so in the United States overall, Americans are continuing much more towards liquidating their physical precious…

Although there were some spurts in retail demand over the past two months or so in the United States overall, Americans are continuing much more towards liquidating their physical precious metals. By itself, this market is so skewed that it is impacting industry cash flow.

Wholesalers are sending more products to refiners to melt down, a process for which it takes longer to receive payment than simply reselling the coins and bars as is. One result is that some in the wholesale industry are slowing down payments to retail and other wholesale dealers, which in turn hurts their cash flow.

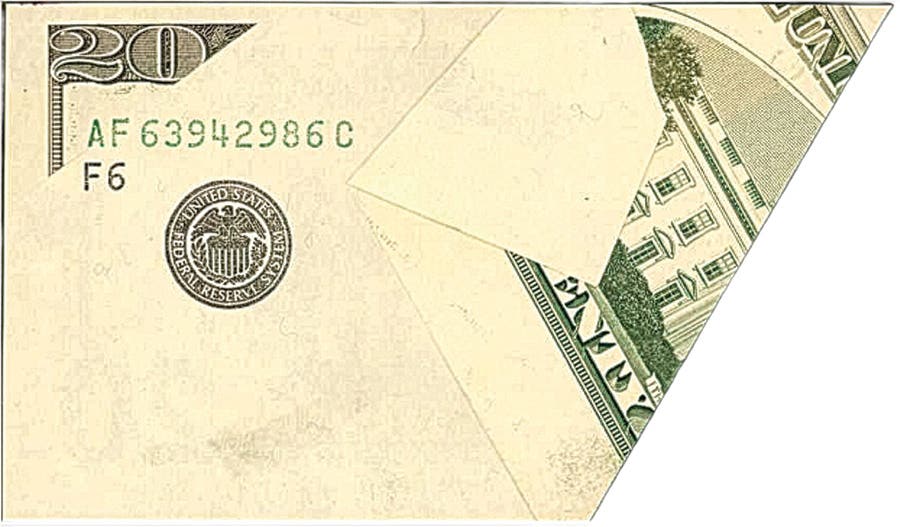

This lack of balance between demand and supply is not the only reason why some wholesalers are slowing down payments. The current higher risks of receiving counterfeit bullion-priced coins and bars now has some wholesalers slowing down how fast they will pay retail coin dealers and other customers for their precious metals.

As an example, one wholesaler will still send out prompt payments to retail dealers with whom they have a long relationship on confirmation of the shipment of gold coins and bars. However, the company will no longer send out payments for silver coins and bars until it receives the actual product and can verify authenticity.

Because of the potential problems with counterfeits, it is likely that this delay in paying for bullion-priced silver may be a permanent feature of the market. It could expand to other metals.

With this slowdown in cash flow, don’t be surprised if retail coin dealers expand their buy/sell spreads for bullion-priced precious metal coins and bars, especially on what they will pay to purchase products.

This circumstance does provide an opportunity for those retail customers looking to acquire bullion-priced coins and bars right now. The premiums for several products have fallen below long-term norms. Plus, if a buyer wants to ask for a small cash discount from a local dealer, such an offer may be given greater consideration than in years past. Don’t be shy about asking, as the worst you might hear in reply is “no.”

About the problem with counterfeits: although small now, it will almost certainly grow in the future. Some wholesalers tell me that they now use a tester on every single coin or bar that they receive that they did not themselves obtain direct from the original manufacturer. This increases labor costs, which invariably will show up in wider wholesale buy/sell spreads.

While longtime dealers can often detect many counterfeit coins and bars without the need of a scale or tester, few retail customers handle such items often enough to be able to protect themselves. In the experience of my company, the majority of counterfeits we see were acquired over the Internet or from flea market types of sellers. In such circumstances, the opportunity to be made whole is not necessarily assured and may involve a major hassle.

For their own protection, buyers of bullion-priced precious metals may want to restrict their purchases to companies with long track records or that have been in the same location for an extended time. Also, the best time to be careful about avoiding counterfeits is when they are received from the seller. If purchased in a store, ask if the seller has a precious metal tester or at least a scale where the pieces may be checked for purity and weight. You can obtain physical size and weight specifications on many products from the mint or private fabricator that produced them. Make sure that your purchase matches up for weight, diameter and thickness.

Two more warnings about counterfeits: 1. No precious metals tester has been found that is 100 percent accurate for all products, and 2. Even if the diameter, thickness and weight are all as they should be, there is still the possibility of either having a counterfeit or a genuine piece where part of the interior precious metal has been excavated and replaced with a base metal. These are more reasons to conduct your transactions with a quality dealer.

Patrick A. Heller was the American Numismatic Association 2017 Exemplary Service and 2012 Harry Forman Numismatic Dealer of the Year Award winner. He was also honored by the Numismatic Literary Guild in 2017 and 2016 for the Best Dealer-Published Magazine/Newspaper and for Best Radio Report. He is the communications officer of Liberty Coin Service in Lansing, Mich., and writes “Liberty’s Outlook,” a monthly newsletter on rare coins and precious metals subjects. Past newsletter issues can be viewed at http://www.libertycoinservice.com. Some of his radio commentaries titled “Things You ‘Know’ That Just Aren’t So, And Important News You Need To Know” can be heard at 8:45 a.m. Wednesday and Friday mornings on 1320-AM WILS in Lansing (which streams live and becomes part of the audio and text archives posted at http://www.1320wils.com).

This article was originally printed in Numismatic News Express. >> Subscribe today

More Collecting Resources

• Purchase your copy of The Essential Guide to Investing in Precious Metals today to get started on making all the right investing decisions.

• Start becoming a coin collector today with this popular course, Coin Collecting 101.