Paper Money Market: Good Sales at the BEP

Pennies cost more than they’re worth, the Tubman $20 is stalled, and the $2 bill barely circulates. So why no audit?

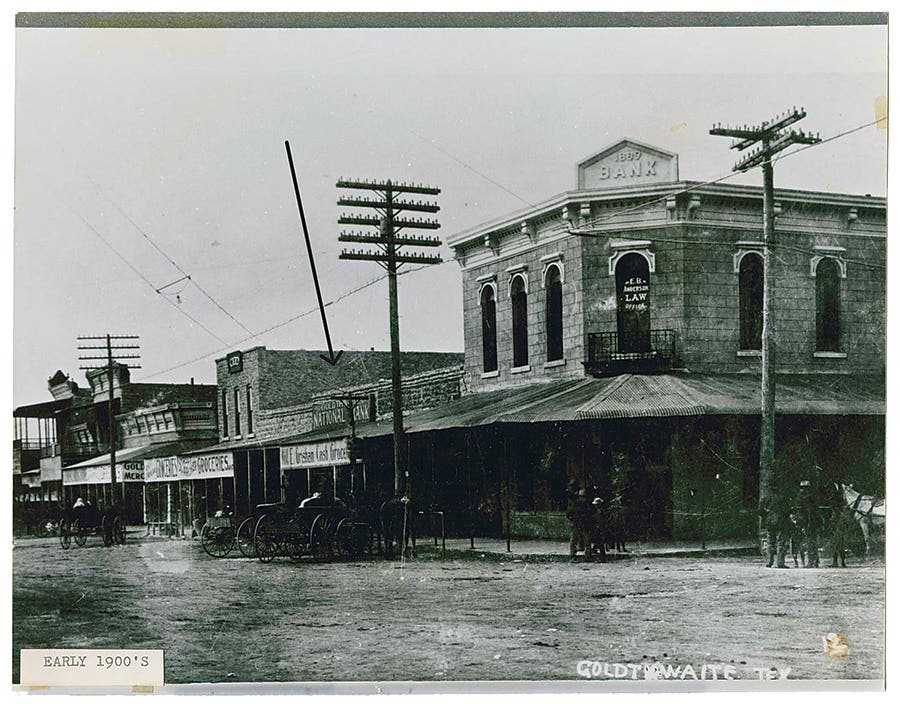

Image courtesy of Harrison Keely via Wikimedia Commons

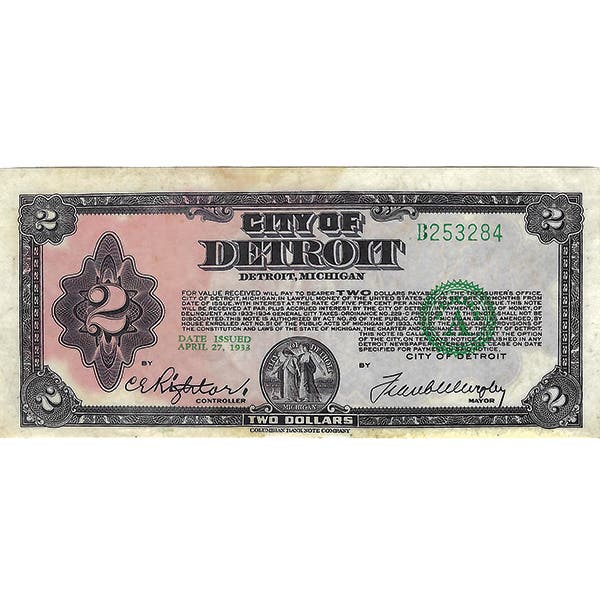

It’s been known for a long time that the cost of producing our 1¢ and 5¢ coins is ridiculously higher than the face value of the minted coins. No one is saying anything about the cost of printing or stockpiling the relatively unused $2 bank note or the expense we are incurring as the proposed Harriet Tubman $20 continues to be developed over what appears to be an inordinate amount of time.

The Trump administration is auditing just about every aspect of governmental departments, but at the time this commentary is being written, there has been no news of an audit or other close examination of the operations of the U.S. Mint or the Bureau of Engraving and Printing (BEP).

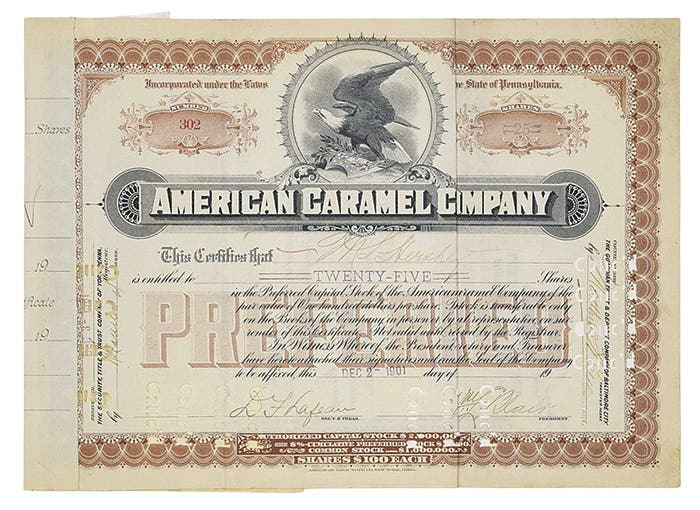

Image courtesy of United States Mint.

According to Public Law 81-656, the BEP is financed through a revolving fund that is disbursed for administrative expenses and other direct and indirect costs through product sales. It has been estimated that the BEP prints about 38 million bank notes with an estimated face value of $541 million daily. The BEP’s Public Sales Program, through which numismatic products are offered, resumed sales in late 2023. The most popular BEP products appear to be their uncut currency sheets.

There is a 56-page “Annual Financial Report” through which the nuts and bolts of the bureau are presented. According to BEP Director Patricia Collins, “The BEP ended the fiscal year with a net positive income, successfully delivering 5.7 billion currency notes in FY 2024 to the FRB and is on track to complete BEP’s Annual Print Order commitment of 5.9 billion notes for calendar year 2024.”

Since the BEP does not appear to be in the same quandary as the U.S. Mint, the only efficiency that might need revisiting is the $2 and development of a different $20, but that’s speculation on my part.

You may also like: