Hotz Off the Press – In Session at Washington Court House, Ohio Part 2

How a small-town bank and its notes became unexpectedly tied to one of the biggest political scandals of the 1920s—Teapot Dome.

This is part two of a two-part series on the Midland National Bank of Washington Court House, Ohio, from Bank Note Reporter magazine. It is available in the July 2025 issue. Part one, from the June 2025 issue, is linked at the bottom of the page.

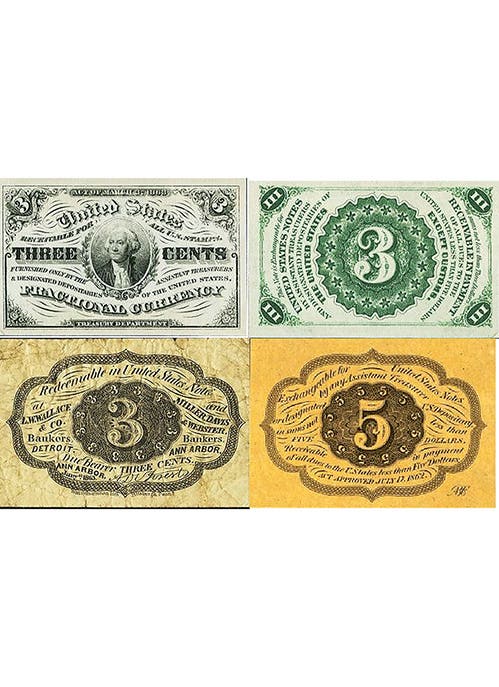

Last month, we examined the history of Midland National Bank and Washington Court House, learning how the bank used the unique moniker “Washington C.H.” to describe its location on the tombstone of its notes. As the bank closed in 1928, this style can only be found on large-size notes.

What makes this bank even more interesting is that it and its president became involved in the biggest political affair of the 1920s—the infamous Teapot Dome Scandal. The scandal nearly toppled Warren G. Harding's presidency, and the investigation occupied years of the Coolidge administration following Harding’s untimely death in 1923. Let’s take a look at the background of this matter.

The Teapot Dome scandal was a major political controversy in the early 1920s that involved the secret leasing of federal oil reserves at Teapot Dome in Wyoming, as well as reserves in California, to private oil companies. These reserves were initially designated for national defense, but Secretary of the Interior Albert B. Fall authorized the leases without competitive bidding in exchange for personal bribes and favors. The scandal exposed widespread corruption within the Harding administration, revealing how government officials prioritized personal enrichment over public interest. The illicit deals were conducted secretly and only came to light through investigations that uncovered these abuses of presidential authority. Investigations began in earnest in 1924.

Major players in the scandal included Secretary of the Interior Albert B. Fall, who orchestrated the leasing arrangements and accepted bribes from oil executives such as Harry F. Sinclair of Sinclair Oil and Edward L. Doheny of Pan American Petroleum. Fall’s covert negotiations allowed these companies to exploit valuable natural resources. Harry M. Daugherty, who served as Attorney General, was also involved in various political scandals of the era. However, his direct role in the Teapot Dome affair was less prominent than Fall’s. Nonetheless, Harry’s position and influence raised concerns about widespread corruption in the Harding administration. The involvement of these key figures highlighted the deep-rooted issues of greed and abuse of power at the highest levels of government during this period.

The fallout was significant, with Albert B. Fall ultimately becoming the first member of a U.S. cabinet to be convicted of a felony for crimes committed in office. In 1929, Fall was found guilty of accepting bribes and was sentenced to prison. The scandal damaged public trust in the government and prompted calls for reforms to increase accountability and transparency in federal dealings. This scandal remains one of the most infamous examples of political corruption in American history, illustrating how greed and lack of oversight can undermine government integrity and lead to widespread consequences.

Those of you who read last month’s article carefully might have realized by now that the president of the Midland National Bank, Mal “Mally” S. Daugherty, was the brother of Attorney General Harry Daugherty. Although not directly implicated in the scandal, Harry Daugherty was harshly criticized for refusing to investigate the allegations outright. Accordingly, many considered that the Attorney General was in cahoots with the main actors in the affair.

Photograph courtesy of Fayette County Historical Society.

Mally S. Daugherty became involved when allegations arose that Harry Daugherty had pressured a government official to deposit seized enemy funds from World War I into the Midland National Bank, which his brother ran. The apparent improprieties led to the U.S. Senate creating the Select Committee for the Investigation of the Attorney General. Sensing that the Midland National Bank of Washington Court House may have been involved in financial shenanigans, the committee issued subpoenas for Mally to appear before the committee to testify and to bring the bank's financial documents. He simply ignored the subpoena and refused to come to Washington, D.C.

As a result, two committee members went directly to Washington Court House, Ohio, and held a special session at the Cherry Hotel in town. Again, they subpoenaed Mally, along with several bank officers. He refused to appear before the committee and ordered bank employees not to testify before it. Accordingly, the Senate President Pro Tempore Albert B. Cummins issued a warrant ordering the Sergeant-at-Arms of the U.S. Senate to arrest Mally and deliver him to the committee in Washington, D.C. Learning of this, Mally and his attorneys decamped to Cincinnati to appeal the warrant issue, where he was taken into custody by John J. McGrain, deputy to the Sergeant-at-Arms of the U.S. Senate.

Mally’s attorneys immediately applied to the U.S. District Court in Cincinnati for a writ of habeas corpus, which was granted based on the court’s decision that the Senate, in directing the investigation and in ordering the arrest, exceeded its powers under the Constitution. He was released from custody and never appeared as a witness before the Select Committee.

This, however, was not the end of the matter. The U.S. Department of Justice, with Deputy John J. McGrain as the plaintiff, appealed to the U.S. Supreme Court, arguing that the U.S. Senate had the power to enforce its subpoenas and compel a private individual to appear before it or one of its committees and give testimony needed to enable it efficiently to exercise a legislative function belonging to it under the Constitution.

In McGrain vs. Daugherty (273 U.S. 135), decided on January 17, 1927, the U.S. Supreme Court ruled unanimously that indeed the U.S. Senate (and the House of Representatives) had the power to enforce its subpoenas, writing that “the investigation was ordered for a legitimate object; that the witness wrongfully refused to appear and testify before the committee and was lawfully arrested; that the Senate is entitled to have him give testimony pertinent to the inquiry, either at its bar or before the committee; and that the district court erred in discharging him from custody.” The decision of the District Court in Cincinnati to release Mally under his habeas corpus petition was reversed; however, the matter was not followed up, and he never appeared before the committee.

The McGrain v. Daugherty case is significant because it established Congress's power to conduct investigations and compel testimony from private citizens, even in the absence of a specific legislative purpose. The ruling essentially affirmed that congressional investigative power is a necessary auxiliary to the legislative function.

Mally returned to Washington Court House, Ohio, and oversaw the closing of the Midland National Bank in 1928 and the consolidation of it, the Commercial Bank, and the Fayette County Bank into the Ohio State Bank, which he ran as president. In 1930, due to the effects of the Great Depression, the Ohio State Bank failed, resulting in heavy losses to depositors, who received only 28¢ to the dollar in the ensuing liquidation.

Mally was blamed for this and became a pariah in the community, with his once-shining reputation shattered. Despite everything he had done to benefit the community, he lost most of his friends and lived on in relative obscurity.

His wife, Elizabeth Strickle Daugherty, died in 1942, and he continued to live alone, with the help of a housekeeper, until 1947, when, according to his obituary, “he went to make his home with Mr. & Mrs. Tom Easton, well-known colored residents of the city.” He had a stroke in late 1948 and died on December 14, 1948, aged 86.

Often, the signers of national bank notes were prominent local community members. Sometimes, as was the case here, they had far more significant effects on national history. I was not aware of the importance Mally S. Daugherty had in U.S. judicial history when I purchased the $5 brown back note; that information was passed on to me by the dealer who had fished the note out of the “woods” and consigned it to auction, from where I purchased it.

Readers may address questions or comments about this article or national bank notes to Mark Hotz at markbhotz@gmail.com.

Related: