Paper Money Market: Low Competition for BEP Contract

From Paul Revere to modern anti-counterfeiting tech, Crane Currency’s long-standing role in supplying U.S. bank note paper highlights why competition in this highly controlled space remains elusive.

Crane Currency and U.S. bank notes are so intertwined that it appears the company has a permanent lock on supplying the Bureau of Engraving and Printing (BEP) with the security paper needed to print America’s currency. In fact, although Crane has been selling the paper to the BEP without interruption for many years, the problem is not that Crane is trying to have a monopoly on the business but that competitors haven’t been in a hurry to step forward.

Crane recently acquired “a significant stake in” Antares Vision SpA, which designs, manufactures, installs, and maintains inspection and detection systems that ensure product safety and quality control. Antares has developed software that aids in preventing counterfeiting. Saak said of the acquisition, “We continue to execute our strategy to be the leading provider of trusted technology solutions that secure, detect, and authenticate our customers’ most important assets. I look forward to providing additional updates on our 2026 outlook during our Q3 [third quarter] earnings call.”

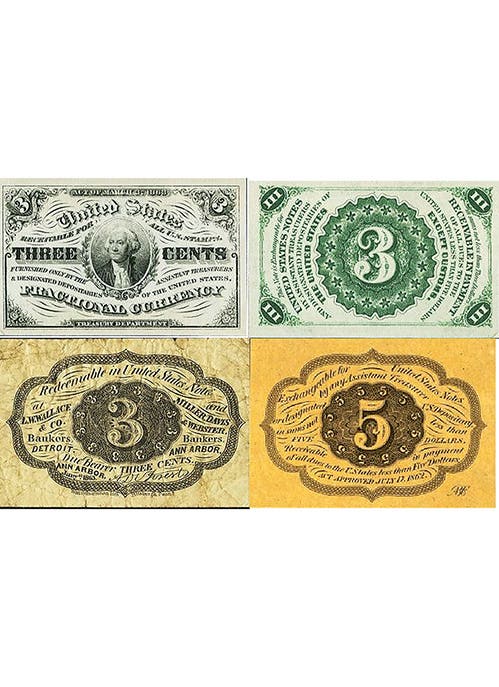

Crane and Company was established as a papermaker and stationery supplier in 1770. Among its early clients was Paul Revere, who used their paper to print the first paper money for the American Colonies.

Crane began selling paper to the BEP in 1879, but by 1984, the company was required to compete for the contract under the Competition and Contracting Law. Part of the problem is evident in the statement on the BEP website: “The paper is made specifically for the Bureau of Engraving and Printing by Crane Currency in Dalton, Massachusetts, and it is illegal for anyone other than [the] BEP to possess this paper.”

If it’s illegal for anyone else to possess this paper, how can a potential competitor to Crane develop security paper that meets the BEP’s requirements? Incidentally, in 2015, Crane Stationary sales represented less than 10% of revenue. Crane sold that division in a management buyout to Mohawk Fine Papers, which purchased Crane Stationery in 2018. The Covid pandemic disrupted sales, leading the Mohawk chief executive to wryly remark, “If you are making toilet paper, you are a winner!” Crane Stationery shifted ownership again following Italian luxury packaging manufacturer Fedrigoni’s purchase of Mohawk in 2024; the company is now owned by WP Strategic Holdings.

Sometimes we feel our bank notes aren’t worth the paper they are printed on. They aren’t toilet paper.

You may also like: