Proof gold Eagles down by third

Gold rebounded after testing the $1,078 level but then gave back its gains. It is apparent that there is significant selling coming into the markets every time they rally, which is a probable indication of further softness in the short term.

Gold rebounded after testing the $1,078 level but then gave back its gains. It is apparent that there is significant selling coming into the markets every time they rally, which is a probable indication of further softness in the short term. An unexpected rise in jobless claims hammered the precious metals. Last time I mentioned the premiums on generic common date U.S. gold eagles and double eagles.

Now many of them have dropped nearly 20 percent as of this writing.

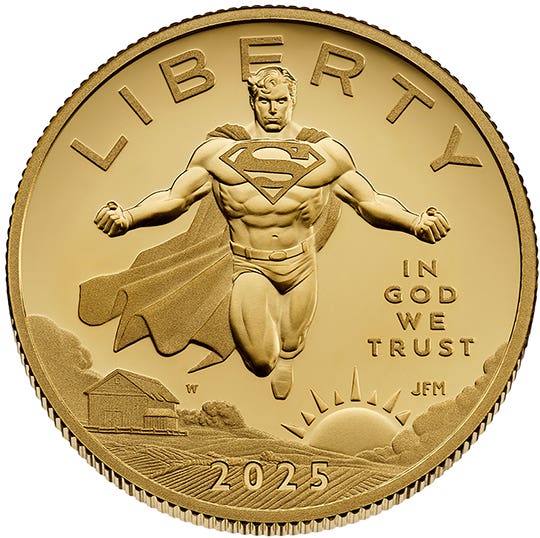

Proof silver Eagles remain constant at recent levels but their big brothers, the proof gold Eagles are down nearly one-third from their peak in December. Platinum issues remain firm with continued accumulation by a few who have been known to be very smart buyers in the past.

Early copper remains strong and there is noticeable attention to the Flying Eagle arena of late; over the past few months lower grades have moved up in response to promotional activity and now several levels of the Mint State grades have shown increased demand and upward prices.

Proof type is in strong demand and proof Indian cents have upward bias.

At the Long Beach Show set-up there was a positive buzz and good indications for the retail bourse opening. Dealer-to-dealer pre-show activity was brisk. This is a good signal.

More Resources:

• Subscribe to our Coin Price Guide, buy Coin Books & Coin Folders and join the NumisMaster VIP Program