New Publication on U.S. Treasury Notes

A fresh perspective on the history of United States paper money arrives with Stack’s Bowers Galleries’ publication of United States Treasury Notes 1812-1865: An Illustrated History, by Nicholas J. Bruyer….

A fresh perspective on the history of United States paper money arrives with Stack’s Bowers Galleries’ publication of United States Treasury Notes 1812-1865: An Illustrated History, by Nicholas J. Bruyer. Bridging the gap between the Continental Currency of the Revolutionary War and the paper money issued by the United States to fund the Civil War, the 271-page hard cover book chronicles how the Treasury repeatedly used Treasury notes as a form of national currency in its times of greatest need.

Peter Treglia, Director of Currency at Stack’s Bowers Galleries stated "Nicholas J. Bruyer's insightful book not only sheds light on the importance of various types and issues of currency, but it also unravels the mysteries that collectors and scholars have long pondered. With meticulous research and a keen eye for detail, Bruyer masterfully connects the dots, providing the answers to longstanding questions. From the earliest days of U.S. issued Treasury Notes to the Civil War, this book serves as a definitive resource, furthering our understanding of our nation's monetary heritage. Prepare to embark on an enlightening journey as Bruyer weaves together the threads of history, offering profound insights and a newfound appreciation for the importance of early U.S. Treasury Notes.”

Treasury notes were authorized under the U.S. Constitution as “bills of credit,” interest-bearing financial instruments of low denominations issued for short terms. Since the Constitution forbade the issuance of paper money by the government, the Treasury repeatedly turned to Treasury notes when it lacked sufficient gold and silver coin during deep recessions or wartime demands. The notes were issued in small sizes convenient to pass hand-to-hand, with interest ranging from 7.3 percent to no interest at all. Although opposed by “hard money” advocates in Congress, the notes were issued in denominations as low as $3. And while some notes were made payable to specific individuals, many were payable to bearer to encourage their use as a circulating medium.

Drawing upon Treasury Department documents in the National Archives, Congressional records and contemporary press accounts among other sources, Mr. Bruyer explores the use of Treasury notes by a succession of Treasury secretaries to meet the nation’s financial needs during the War of 1812, the Panic of 1837, the Mexican War, the Panic of 1857 and the War of Rebellion. The greatest use of Treasury notes occurred during the Civil War under Treasury Secretary Salmon P. Chase, who initially believed he could pay the entire cost of winning the war solely using Treasury notes, without new taxes or bonds. As the war progressed, Chase experimented with different kinds of Treasury notes, including coupon-bearing notes, before settling upon a 6 percent note yielding compound interest in June 1864. “U.S. Treasury Notes 1812–1865 is more than a catalog; it’s a well-reasoned study that offers new perspectives in American financial and economic history” commented Dennis Tucker, Publisher, Whitman Publishing.

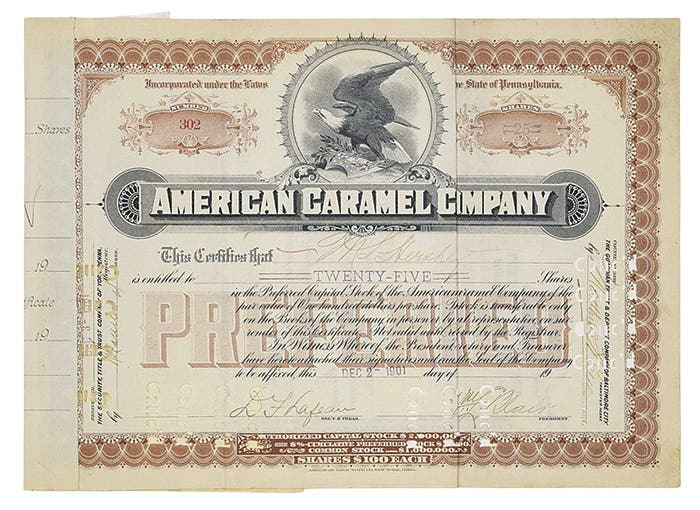

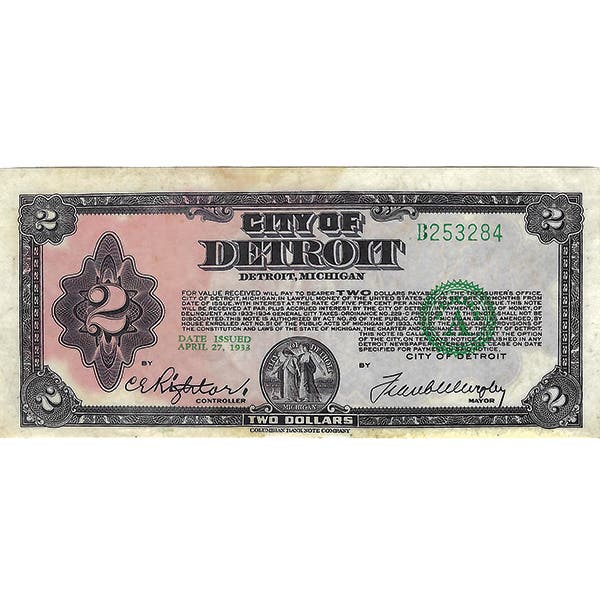

United States Treasury Notes is the most extensively illustrated of any reference work yet published on the subject. Most notes are shown in color and include specimens from major auction houses and the Smithsonian Institution. Many are rare or even unique, the only known surviving examples. Individual notes illustrated in book have sold for upwards of $1 million at auction.

Students of Civil War currency may be surprised to learn that the non-interest bearing “Demand” notes of 1861 were in fact the second issue of such notes by the Treasury. The first Demand notes, in a $50 denomination, were issued in 1843 by Treasury Secretary John C. Spencer. They were payable on demand at any one of three federal depositories in New York. $1.3 million were placed into circulation before Congress concluded the notes were unconstitutional and prohibited Spencer from continuing his paper money experiment. Despite Congressional disapproval, the $50 Demand notes were favorably received by the public and circulated for years.

The book also dedicates space to the periods before and after the War of 1812 with chapters on the First (1791-1811) and Second (1816-1836) Bank of the United States. Arguably, if either institution had survived the politics of its times, there would have been no need for the U.S. government to issue its own circulating currency. However, growing distrust of British shareholders, who owned a majority of the First U.S. Bank at a time of increasingly prickly relations with the British government, sealed its fate. The Second Bank fell victim to President Andrew Jackson’s dislike of bankers in general and what he called the “monster bank” in particular. This new book organizes the paper money of these banks in easy-to-follow chronological sequence. Circulating drafts, a form of paper money created to avoid the requirement for notes to be hand-signed by the Second Bank’s president and chief cashier, also are described and illustrated.

Anyone interested in the monetary history of the United States and its paper money, from the beginning of the federal era through the end of the Civil War, will find United States Treasury Notes to be valuable as an introduction and a foundational reference. Well-known author and currency specialist, Art Friedberg remarked “A sorely needed book on a subject that has long been insufficiently studied and overlooked by all but a small segment of collectors. It is comprehensive, well written, and beautifully designed and illustrated.” It will be published in mid-August and sold by Stack’s Bowers Galleries, America’s oldest numismatic auction house. The book will have a list price of $59.95 and will be available at Amazon.com – simply search “United States Treasury Notes 1812-1865”.