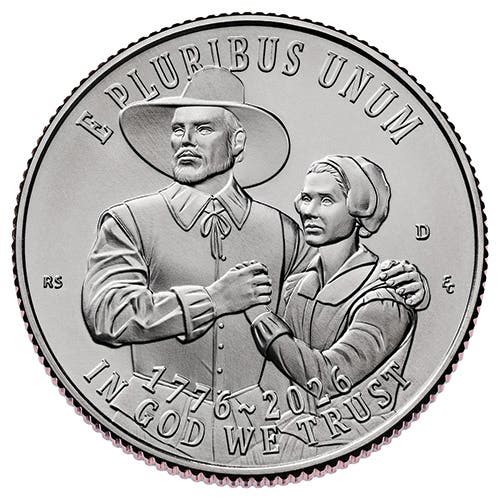

1913 nickel gains faster

With evidence that the mini-Depression of 2009 is behind us, collectors will have the rare opportunity to ring in the New Year at the Florida United Numismatists convention with the Heritage auction featuring one of the five known examples of the 1913 Liberty Head nickel.

With every bit of evidence that the mini-Depression of 2009 is behind us, and signs pointing to economic recovery and expansion, collectors will have the rare opportunity to ring in the New Year at the Florida United Numismatists convention with the Heritage auction featuring, amid other rarities, one of the five known examples of the 1913 Liberty Head nickel.

It has a rich history and a performance as an investment that would please any owner.

Of the five coins, two are off the market permanently in museums. The Norweb specimen was donated to the Smithsonian Institution’s National Numismatic Collection in 1978, and the Aubrey and Adeline Bebee specimen went cross-country to the Colorado Springs. Colo., museum of the American Numismatic Association, the national coin club, in 1989.

This is a coin whose name packs lots of moxie, and has a punchy story. It’s the first coin ever to sell in six figures – it went for $100,000 in a 1972 private treaty sale brokered by Abe Kosoff, selling Edwin Hydeman’s 1913 nickel to Worldwide Coin Investments of Atlanta.

Shortly thereafter, the same six-figure coin starred in a “Hawaii Five-O” television episode opposite Jack Lord, while the master criminal played by veteran character actor Victor Bono held the coin (by its edges) and looked at it menacingly through a magnifying glass (“Book him, Danno).

This is a coin with a lot of sizzle. It is an historic coin that has a long and involved history that dates back some 90 years to the time in December 1919 when a former Mint employee Samuel Brown advertised in the ANA’s monthly periodical, The Numismatist, that he was willing to buy an example of the coin for $500.

In 1920, he raised the price to $600 a coin.

There were no takers – there couldn’t be, since Brown had all of the specimens that existed and was simply advertising to try and create a market. Oh, was he successful. So much so that in the 1930s in the midst of a national depression, one Texas dealer, B. Max Mehl, initiated a national search by offering to buy the nickel for $50.

Advertising on the back of match books (used to light cigarettes), and that new fangled medium, radio, Mehl pounded away that he was willing to pay $50 for five cents to the point that a national feeding frenzy existed to try and locate the coin.

All the evidence points to the fact that Brown had struck the coins on Mint machinery, using government dies, on government planchets that were around the Mint, awaiting the decision of the Treasury chief to change the design to the Indian Head obverse and Bison reverse.

Eventually, it would come out that there were five specimens produced, all tracing their pedigree to Brown.

In the 1920s, they were acquired as a group by Col. Ned Green, son of “Witch of Wall Street” Hetty Green, and in 1941, they came into possession of Eric P. Newman and Burdette G. Johnson, who were in the process of settling the numismatic holdings of the Green estate. By late 1941, all five went to Newman, who is still around at age 98, a respected St. Louis attorney and skilled numismatic researcher.

In the early 1930s, Fort Worth dealer B. Max Mehl organized a national campaign to find what collectors refer to as the so-called “sixth” 1913 Liberty nickel, offering to pay $50 for it (big money in the Depression) – and popularizing his mail-order business in the process.

The advertisement offered: “Old Money Wanted. Will pay Fifty Dollars for Nickels of 1913 with Liberty head (no Buffalo).” None, of course, were ever turned in – but Mehl reaped publicity in print and on the radio, and went on to become the biggest coin dealer in the world, despite his own diminutive size.

Fred Olsen, whose collection B. Max Mehl later sold, was a buyer in 1941 at $900 from James Kelly. So was Dr. Conway Bolt, of North Carolina, at $2,450, also from Kelly. Fred C.C. Boyd acquired a specimen around 1941 as well – price not known– as did J.V. McDermott.

There are about 19 different sales records, a veritable who’s who of modern numismatists, who are owners or former owners of the 1913 Liberty nickel.

The ubiquitous King Farouk, everybody’s dandy when it came to rare coin purchases, acquired two in 1944, one for $2,750 the other a thousand dollars higher, $3,740. Both were promptly disposed of.

Edwin Hydeman bought one for $3,750, and George Walton got another, trading coins valued at $3,750 in 1945 for the King of Coins. Abe Kosoff had another sale, this time in 1948, at $2,000, Louis Eliasberg then bought it from Kosoff for $2,350. Sol Kaplan bought one in 1954 for $3,650 and sold it to the Norwebs for $3,900.

Next recorded sale was the dramatic purchase by Aubrey Bebee at the 1967 American Numismatic Association convention in Miami, where a $46,000 winning bid was received. At the time, it was the highest sum then ever received at public auction for any coin.

In 2010, where many coin prices routinely are in six figures, and many have gone over a million dollars, it is hard to appreciate the impact that the 1967 Bebee purchase had on the coin market. It became a figure to strive for.

Not much later– five years to be precise – World Wide Coin Investments of Atlanta bought the Hydeman specimen for $100,000 – the first time that any coin had reached that price in public auction or private treaty. Kosoff brokered a deal selling the 1804 silver dollar as part of the same transaction, which combined at $180,000.

(The 1794 dollar that Superior sold as part of the Ruby collection in 1973 to T.V. producer Ralph Andrews for $110,000 turned out to be the first public auction sale at that six-figure level).

Briefly, the 1913 Liberty nickel was the start of the popular “Hawaii Five-O” television series as actor Victor Buono plotted to steal the coin – and armed guards stood on the set to make sure that the six-figure investment was maintained. The show was a police drama with the catchy theme music that aired from 1968-1980.

Next in recorded sales came Dr. Jerry Buss (1978) at $200,000 when he acquired the World Wide specimen. His own collection was sold in 1985 by Superior Galleries (Larry, Ira and Mark Goldberg) and Reed Hawn was the buyer at $350,000. Dwight Manley for Spectrum Numismatics, later bought that coin in 1993 for $875,000. (This is the coin being offered at the 2010 FUN sale in Florida).

Intervening, Jay Parrino was a 1996 buyer for $1.485 million, followed by the sale of the Dwight Manley-Jerry Buss-Reed Hawn specimen for $1.83 million. Legend Numismatics acquired that one. The Manley and Legend purchases at the identical $1.84 million sum came a year apart (2001-2002). In the summer of 2003, Manley sold his remaining specimen to Edward Lee, the New Hampshire coin dealer, for about $3 million.

It’s never entirely fair to use a “type” or “date” as a substitute for identical transactions, but for purposes of rare coin analysis, one 1913 Liberty nickel is so rare that it becomes a generic substitute for another – even if the other is in slightly better or worse condition.

By doing that, you have the ability to see over a period of nearly 70 years, just how this rare coin did compared to the Consumer Price Index, how it did compared to a market basket of other coin rarities (that admittedly cost a lot less), and even how it did compared to the Dow Jones Industrial average.

Put differently, if you had invested $2,450 that Dr. Conway Bolt did in 1944, or if you had spent $900 as Fred Olsen did in 1943, or the $46,000 that Aubrey Bebee did in 1967, how would that compare with a comparable investment in stocks and bonds, and how would it measure against the Consumer Price Index, prepared by the U.S. Bureau of Labor Statistics?

The accompanying charts show what those of us who have followed the coin market have known for years: rare coins can be a solid investment when you buy rarity and don’t overspend the marketplace.

The market basket that I utilized for measuring performance is taken from the Salomon Brothers survey that began in 1978 and ended in 1990. Readers of this column know that I have extrapolated the data and extended it backward to 1938, as well as forward to 2010. The composite from the 20 coins in that survey were used as an added measuring device.

Using price derivatives of the component coins and going back to 1941 – the first year of a recorded selling price for the 1913 Liberty nickel – and bringing them forward nearly 70 years to 2010, provides a rich digest and appreciation of just what kind of investment return coins can have when compared to many other forms of more traditional investment.

The original Salomon Survey covered gold, silver, old masters (art), foreign exchange and other assets with reportable daily prices were contrasted with farm land sales, the Consumer Price Index and the more traditional stocks and bonds – all in the name of seeing which rate of return was the most profitable.

Federal Reserve Bank of Boston’s use as a chart of what had been a private survey circulated among Salomon’s clientele offered a startling conclusion: that over the preceding 10 years – an unparalleled growth period in the rare coin field – rare coins’ sizzle substantially outpaced equities.

Comparison with the 1913 Liberty Nickel proves no less.

Like the Dow Jones average, which neither represents all publicly held companies, or even all significant stocks that trade on the exchange – each coin in the Salomon Brothers rare coin portfolio was intended to be broadly representative of the marketplace as a whole, and to that extent, its trend-line symbolizes what the market actually does.

Components of the rare coin portion of the Salomon study were selected by the firm chosen by Salomon Brothers to perform the function of monitor, Stack’s of New York City. According to one of its principals, Harvey G. Stack, the index was never formulated with the intention of showing that rare coins were an investment, per se.

Instead, the market basket chosen constituted coins that were selected principally because they were type coins that might be found in a serious collection, but not necessarily a collector who viewed only the best condition possible as worthy of inclusion in the collection.

Because the original index was created in 1978 – when numerical grading was a rarity, except for early American copper coinage – any current comparison must make a methodology change to try and take into account not only the vagaries in today’s standards, but also those of a generation ago.

None of the 20 coins included in the market basket were of gem quality – the word “gem” was used then, but not as strictly as it is today – so most of the coins included were choice uncirculated, the equivalent of MS-63 on most of the numerical grading scales that are now employed. The 1913 Liberty nickel being compared is Numismatic Guaranty Corp. Proof-64.

Listing of coins that were included in the Salomon Brothers annual survey of collectibles were first made public by Neil S. Berman and Hans M.F. Schulman in their guide book on rare coin investment, The Investors Guide To United States Coins (Coin & Currency Institute, 1986).

The listing includes a half cent, a two and three cent (nickel) piece, a five-cent coin, a silver three-cent piece, a half dime, two dimes, a 20 cent piece, three quarters, four half dollars of regular issue, three silver dollars and a single commemorative half dollar.

The portfolio, when matched against the 1913 Liberty nickel, shows a favorable impression until the recent price purchases – under which the 1913 nickel pulls ahead – but not by a lot.

Comparisons with the Consumer Price Index show an average increase (1938-2010) of about 4.5% annually. Not every year; right now, for example, it’s about 2.17 percent annually. But in the early 1980s, the rate was 13.5 percent annually – a substantial amount by any stretch.

Over the same time frame, the market basket of rare coins has averaged a 13.4 percent rate of return. The 1913 Liberty nickel has a none-too-shabby average rate of return, 1941-2010, of about 11.79 percent, compounded rate of return (using $3,750 paid by Olsen to the $3 million sale in 2004.

Reed Hawn got a good return on his investment, too. He paid $385,000 for the Jerry Buss specimen and when his collection was sold eight years later, it brought $962,500, a compounded rate of return of 12.14 percent.

(In the Salomon Brothers portfolio, coins in the model portfolio include coins that you might have in your own collection, like an 1847 Seated Liberty dollar MS-63, a 1921 Walking Liberty half dollar in MS-63, a 1916 Standing Liberty quarter in MS-63, an 1873 Proof-63 two- cent piece, or a 1794 half cent in XF-40).

Far outpacing the CPI (the overlay understates the percentage gap), the intriguing comparison with the Dow Jones Industrial Average shows that that guide undertook an expansion at the un-compounded rate of 8.24 percent a year over the past 72 years (from 1938), the roughly comparable period for the 1913 and market basket.

If you knock out the war years and start the Dow analysis from 1945 until the present, the growth rate is just about 9 percent annually – the coin portfolio record and that of the 1913 Nickel truly speak for themselves.

Of course, during all this time, coins did not go up every year. In fact, from 1938 to 2010, the portfolio declined in more than 11 separate years. (The Dow declined in 18 separate years over the same time frame).

So as we wait for the auctioneer’s gavel to hammer down the 1913 Liberty nickel at the FUN sale, its price can be looked at in context, and used as a bellwether for the future of the market for the start of a new decade.

More Resources:

• State Quarters Deluxe Folder By Warmans