Physical Precious Metals More Available, Premiums Declining

By the middle of March, demand in the U.S. for physical precious metals, especially gold and silver, was so strong that retailer inventories were largely depleted. As dealers attempted to…

By the middle of March, demand in the U.S. for physical precious metals, especially gold and silver, was so strong that retailer inventories were largely depleted. As dealers attempted to restock from suppliers, wholesale inventories ran out. As primary distributors and other wholesalers sought to order more products from government mints and private fabricators, the mints and fabricators also ran out of immediately available inventory.

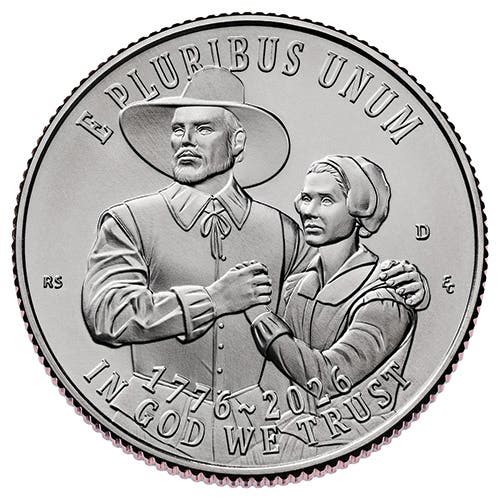

Availability of some products that are no longer in current production, such as U.S. 90 percent silver coins, U.S. American Arts medallions, South Africa krugerrands, Austria 100 coronas, British sovereigns, Mexico 50 pesos, and the like became so haphazard that many retailers were unable to accept orders for them.

Even bullion products in current production – U.S. silver, gold and platinum Eagles; Canada gold and silver Maple Leafs; Perth Mint issues; the Austria Philharmonic coins; and fabricated ingots, bars, and rounds – started to see delivery times stretched out from a few days to several weeks. When problems with the COVID-19 pandemic led to the closure of some mints and fabricators, even more retailers had to limit the number of products on which they could take orders.

As this was occurring, the prices of precious metals became more volatile. As one example, the COMEX close for silver on Feb. 24 was $18.87. At the COMEX close on March 18, just 17 trading days later, the silver spot was down to $11.74. As of Monday, June 1, the COMEX close for silver was $18.77.

Platinum was another highly volatile precious metal. It closed on the COMEX at about $1,007 on Feb. 19, 2020; $588 on March 19 (its lowest close since Dec. 26, 2003) and at $901 on Monday, June 1.

In such markets, with limited product availability and volatile prices, buy/sell spread at wholesalers and retailers widened and delivery times lengthened. High premiums and lengthy product delays discouraged some buyers from making purchases.

How high has the demand increased in 2020 compared to recent years? Just to go the U.S. Mint’s website to check for sales of their bullion products at www.usmint.gov/about/production-sales-figures/bullion-sales. Thus far in 2020, through June 3, the U.S. Mint has sold 337,000 ounces of gold Eagles of all sizes, 11,668,500 silver Eagles and 56,500 platinum Eagles. For the entire year 2019, the U.S. Mint sold 152,000 ounces of gold Eagles, 14,863,500 silver Eagles and only 40,000 platinum Eagles. As you can see, product demand has soared!

Gradually, manufacturers ramped up production, and supplies have returned to the market. In late March, it was not uncommon for retail dealers to have almost no bullion inventory in stock for immediate delivery and only able to take orders for a handful of products for two to four weeks (or longer) delivery. Today, most retail dealers have at least small quantities of a wide range of products immediately available and can get delivery within one to two weeks for most items.

As product availability has improved, the premiums at which products were selling above their precious metal content have also come back down. They are still not as low as they were in early March, but most are well down from their peak premiums.

As one example, on March 11 it was possible to purchase a $1,000 face-value bag of U.S. 90 percent silver coins for as low as about 25 cents per ounce above silver value. By early April, of the retailers who were willing to take orders for this product, prices were $6-$10 per ounce above silver value. Today, retailers are charging $2.50-$5 per ounce over silver value for a bag of these coins, though not all retailers are able to accept orders for this quantity of 90 percent silver coins.

One-ounce gold American Eagles in 10-piece quantities were selling mostly around $60-$70 above the asking gold spot price at many retail dealers on March 11. At the peak in early April, this same quantity of coins would have cost you almost $200 above the gold spot price at some dealers – though not all retailers would accept an order for 10 gold American Eagles. Today, many retailers are charging $115-$125 above the ask gold spot price for orders of this size. When I checked with retailers around the country late last week, all were willing to accept orders for 10 pieces of U.S. one-ounce gold American Eagles.

While supplies are becoming more available and premiums have declined, it is still possible that some products may experience temporary supply shortages. As I type this column, for one example, U.S. 1/10-ounce gold American Eagles are difficult to find in quantity.

In the coming weeks, I anticipate (but cannot guarantee) that premiums are likely to continue to decline further. However, there is growing pressure for gold and silver spot prices to continue rising. Consequently, we will only know for sure after the fact as to when was the “right time” to buy at the lowest product prices in the current market cycle.

The volatility in bullion-priced precious metals physical product availability and premium levels thus far in 2020 repeated a pattern that has occurred several times over the past 40 years. When products are scarce and relative prices rise, manufacturers, wholesalers, and retailers have an incentive to satisfy customer demand. Eventually, supply in the past has caught up to demand.

Patrick A. Heller was honored as a 2019 FUN Numismatic Ambassador. He is also the recipient of the ANA 2018 Glenn Smedley Memorial Service Award, 2017 Exemplary Service Award 2012 Harry Forman National Dealer of the Year Award and 2008 Presidential Award winner. Over the years, he has also been honored by the Numismatic Literary Guild, Professional Numismatists Guild, Industry Council for Tangible Assets and the Michigan State Numismatic Society. He is the communications officer of Liberty Coin Service in Lansing, Mich., and writes Liberty’s Outlook, a monthly newsletter on rare coins and precious metals subjects. Past newsletter issues can be viewed at www.libertycoinservice.com. Some of his radio commentaries titled “Things You ‘Know’ That Just Aren’t So, And Important News You Need To Know” can be heard at 8:45 a.m. Wednesday and Friday mornings on 1320-AM WILS in Lansing.