Gold Trades at Eight-Week High

In what I guess could be termed as a “normal” year, the Florida United Numismatists convention would kick off the new season for coin collectors. In a year in which…

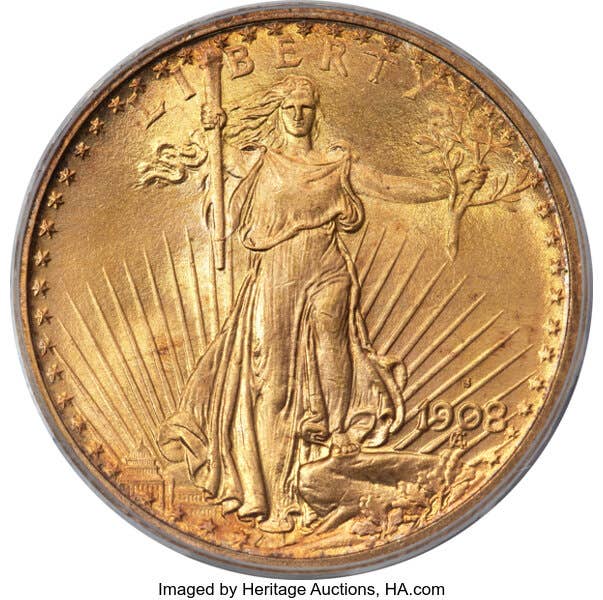

In what I guess could be termed as a “normal” year, the Florida United Numismatists convention would kick off the new season for coin collectors. In a year in which a pandemic has put a lid on a lot of face-to-face activities, this isn’t going to happen. Regardless, consider that the spot price and, subsequently, value of bullion and bullion-impacted gold coins increased more than 24 percent during 2020. Also consider that gold trades are at an eight-week high as this commentary is being written.

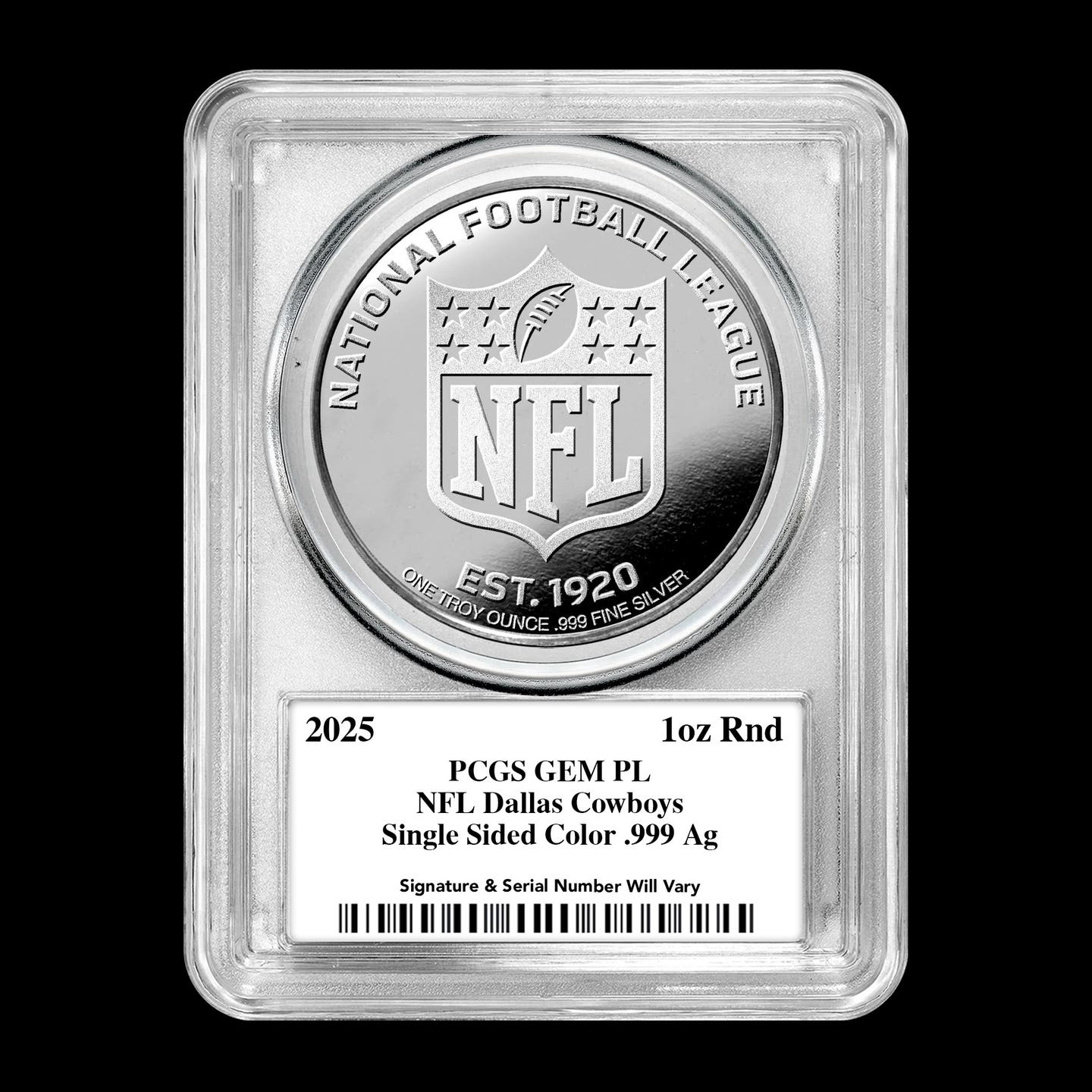

Authorized purchasers of bullion coins from the U.S. Mint were expected to begin receiving shipments of 2021 American Eagle gold and silver bullion coins on Jan. 11.

The top five hammer prices realized at auction during the past year included two 1804 silver dollars, these being coins that always catch the attention of the non-collecting public when they sell. Many significant rarities crossed the auction block during 2020, with more now out on consignment for upcoming auctions. Over-the-counter sales have been surging, not only with collector coins, but with bullion and bullion-impacted coins.

Discretionary money continues to flow out of traditional investments, some of it seeking a new haven in collectibles – especially collectible coins. When the U.S. Mint is challenged to keep up with demand for new issues aimed specifically at collectors, you know you are in a bull market!

The market for coins performed well during 2020 despite a global pandemic. As we overcome the pandemic during 2021, the market for coins can be expected to perform even better.