Bargain Collector: Is “Inexpensive Gold” Even Possible?

When gold feels out of reach, think smaller. These 1/20th-ounce bullion coins from around the world might just be the hobby’s best hidden bargains.

Royal Canadian Mint

Online Coin Club

We have been keeping an eye on the price of gold for all of 2025, simply because the numbers seem to be bouncing around more rapidly than a ping pong ball served up by Olympic players. Virtually all collectors would like to own some gold, but right now it seems like the cost is going to keep it firmly out of reach of those of us who really chase down bargains. So, what we are going to present here might seem like some goofy, insane, last-ditch effort to pull something out of what appears to be an impossible situation. But we are going to look at a few of the countries that produce 1/20th-ounce gold bullion coins for the world markets. Specifically, we’re going to glance at a couple that we might consider major players in the world markets, and a couple that might raise an eyebrow or two. Off we go.

Canada

Our northern neighbors have an absolutely robust program at the Royal Canadian Mint, producing everything from impressive commemoratives to a wide variety of precious metal bullion coins (and go figure, they make the circulating coins of the nation as well!). When it comes to small gold, the RCM has been pounding out 1/20th-ounce gold pieces since 1993. This actually gives us a series we could try to collect, if we have both the time and the patience. The amount of gold in one means that when gold sells for $3,900, there is $195 of the precious metal in each. We’ll probably have to pay a bit more, since dealers have to make a profit and eat, too. Still, this is not too bad.

We did say we were going to focus on 1/20th-ounce gold pieces, but we simply have to mention that Canada also produces a one-gram gold Maple Leaf as well – that’s 0.03215 troy ounces of the yellow metal. This tiny piece, with a face value of $0.50 Canadian, was first pounded out in 2014. For those who are interested, this size means that when gold is trading at the just-mentioned $3,900 per troy ounce, each of these l’il guys contains $125.39 of it. The coin is definitely tiny, but then, so is the price.

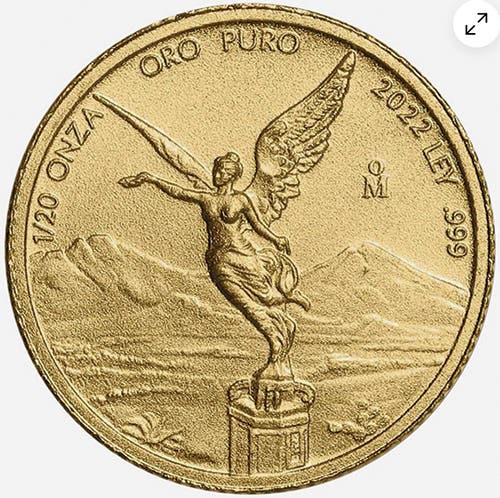

Mexico

Our southern neighbor is no stranger to gold and silver bullion coins, and the Casa de Moneda of Mexico City has been pounding out precious metal coins for centuries longer than anyone else in North and South America. The mineral wealth of Mexico is vast. Their gold Libertad program is one that is traded worldwide, and that is very well known. While they have been into big gold for quite a while, the 1/20th-ounce gold Libertad made its debut in 1991. The production has been going on intermittently since then, which means that any of us who wish to string these small gold pieces together will have to be aware that there are years with no production. But that shouldn’t spoil our collecting fun.

Singapore

In the grand scheme of the precious metals markets and all the folks who buy, sell, trade, and speculate in gold coins, the island nation of Singapore might seem to be a very minor player. But they, too, went into the field of small gold when they came out with their 1/20th-ounce gold Lion in 1990. This little guy sports a $5 face value and has a purity of 0.9999, which matches the Royal Canadian Mint and qualifies as high, meaning as high as anyone gets. Hunting the Singapore Lions down, in any size, will be a bigger challenge than finding the small gold we just mentioned from Canada and Mexico, but these pieces are real beauties.

South Africa

About as far south as we can go, the nation of South Africa is another land with amazing mineral wealth. The famous gold Krugerrands have a longer history than any other nation, at least when it comes to modern bullion coins. But for over a decade, the Krugerrand was a one-ounce gold piece, and there was nothing else in terms of size.

At the 50th anniversary of the Krugerrand in 2017, South Africa produced a proof version of the 1/20th-ounce gold Krugerrand, which means this is a rather limited piece, and the prices will certainly be higher than just the price of the metal. But again, this could be an interesting challenge, just to find one.

Since we noted Canada’s 1-gram gold pieces, we should perhaps also give a nod to the other sizes of Krugerrands that were part of this 50th anniversary. Yes, there is a 1/50th-ounce piece, about as tiny as we can get. But for those of us with loads of cash, it appears there is also a limited number of 5-ounce and even a very few 50-ounce gold Krugerrands. While this is amazing, these will never qualify as bargains, not ever.

Are there others?

Oh my, yes, there are definitely some other nations and lands that have issued 1/20th-ounce gold bullion coins. China, Australia, the United Kingdom, Austria, and the Isle of Man have all gotten into the small gold “game,” as it were. As we have noted, a few have gone even smaller than that, if we can believe it. It can turn into a real worldwide hunt if we were to try to track down one of these small gold bullion coins from every nation that has ever produced one.

Will these indeed be bargains?

The United States gold Eagle coins that are the smallest remain the 1/10th-ounce gold Eagles, at least for now. With that in mind, the handful of 1/20th-ounce pieces we have just taken a peek at can be viewed as having the right price tag – or could be viewed as being just too small for our tastes. However, we choose to look at it, though, this may be as close to a set of gold bargains as we can hope for, at least right now.

You may also like: