Silver Breaks 1980 Record as Metals Soar—and Money Politics Heat Up

Silver tops its 1980 record as gold and platinum surge, fueling debate over fiat’s future and a proposed Trump coin that’s testing U.S. currency tradition.

The spot price of silver has finally set a new record, surpassing the previous high set in early 1980 when the Hunt brothers (Nelson and William Herbert Hunt) attempted unsuccessfully to corner the silver market. Gold and platinum continue to soar in price as well. Is fiat money about to die?

The rally in gold, silver, and platinum suggests specie is back—with a vengeance. How much unbacked fiat cash can central banks continue to print, followed by fiat electronic voodoo, including crypto money? Is the price of gold irrational? Does the increasing spot price of the metal represent the need for tangible security against a non-tangible economy in which the pace of the growth of debt is outpacing the ability to pay even the interest on that debt?

Senior Fellow Robin Brooks at the Brookings Institution recently said, “The market is saying, ‘You guys are going to inflate away the debt, not now but in the long term.” Coin collecting is supposed to be a hobby, but it’s looking more like an investment as long as the price of intrinsically valued and relatively available coins continues to rise. Adding fuel to this fire is the future subject matter to appear on our coins.

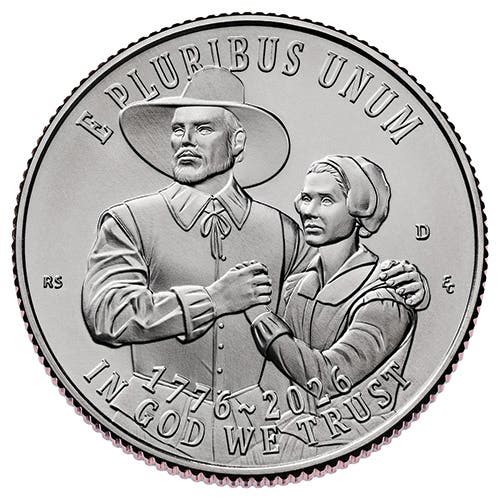

The U.S. Treasury has acknowledged there is a proposed semi-quincentennial dollar coin on which the current President Donald J. Trump would appear. U.S. Code Title 31, Section 5114, and the 1866 Thayer Amendment both forbid portraying a living person on any of our currency. Rep. Ritchie Torres (D.-NY) has proposed further legislation to block the suggested coin. There have been six living people who have already shattered that law. The question now is whether this begins a coin series featuring whoever is the president during that person’s presidency.

You may also like: