Study: physical cash increasing worldwide

The future of banking, especially tellers inside bank lobbies, is changing. So is the future of cash, this being coins and bank notes. The big question for those interested in…

The future of banking, especially tellers inside bank lobbies, is changing. So is the future of cash, this being coins and bank notes. The big question for those interested in numismatics is if the days are numbered for physical currency.

Not so, according to a British testing service. The Smithers Pira service released a study in August that indicates the number of bank notes will increase by about five percent annually between 2016 and 2026. The study did not address coinage directly, but considering the recent move towards eliminating low denomination bank notes and replacing them with coins, the Smithers Pira study could be termed a “coincidence barometer” for the future of coins as well.

According to the Smithers Pira “Fit for Circulation: The Future Lifecyles of Currency to 2026” study, “Modernization of the cash cycle and combined cash infrastructure will lead to higher specialization and consolidation. This centralization will lead to a reduced number of highly automated cash centers, which will have to be located in metropolitan hubs that are able to handle higher cash throughputs. Partnerships between key players along the cash supply chain can be foreseen in countries developing towards the next level of modernization. The selected cash cycles – Brazil, Germany, and Poland – illustrate such future trend and reflect the different strategies of national central banks (NCBs) and the competitive environment in the commercial sector in detail.”

Jens Ederhart authored the Smithers Pira report. According to Ederhart, “Growth of non-cash payments across the 2016-1026 period will vary between countries; with contactless cards, electronic money, and digital wallets are key examples of potentially disruptive future technology seeing wider use. Non-bank players are also challenging the traditional banking landscape by offering new digitalized financial services mainly in combination with mobile devices. Although virtual currencies, like Bitcoin, will remain a niche payment method for the foreseeable future.”

The report identified the challenges being posed to physical cash by electronic and smart device payment methods, the increasing automation in cash cycles, the computerization of cash shipments, the wider use of cutting edge technology anti-theft technologies, the practice of price rounding employed by an increasing number of countries, and the integration of coin and bank note features. The volume of coins being minted and the impact of seigniorage on coin production is also reviewed in the study.

The Smithers Pira report is based on research conducted with monetary decision makers and various specialists at central banks, technology suppliers, and industry consultants.

According to Ederhart, the report is also supported by secondary research on the future of cash cycles based on private databases, supplier web sites and brochures, technical papers, and related conference proceedings. Key data was provided to illustrate and put into context the transformative trends in the currency marketplace for future currency production volumes and cash cycle strategies.

The report forecasts physical cash will continue to be the key medium for payment and the storage of value into the future.

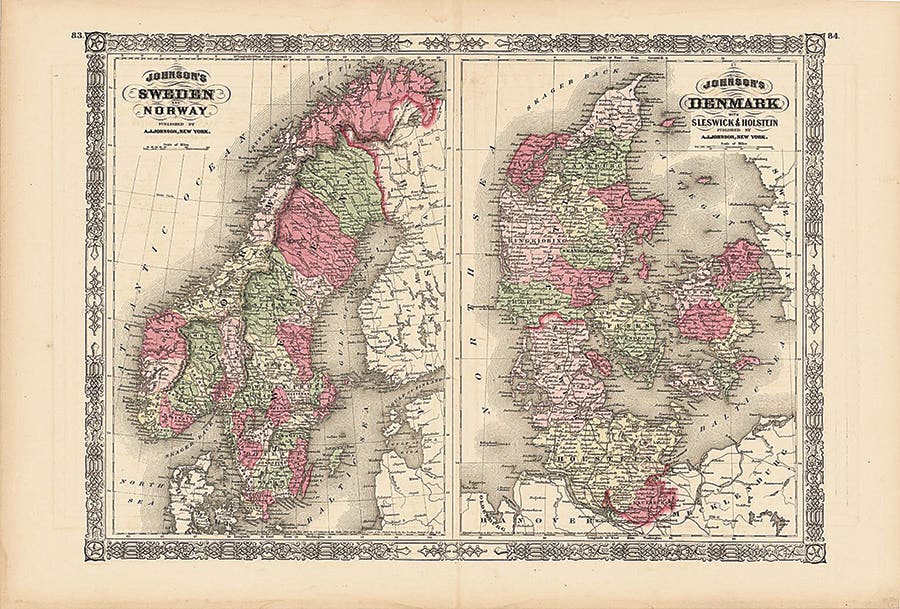

Countries including Denmark, Sweden, and Taiwan are moving towards cashless societies in which all value transfers will be done electronically. Concerns have been voiced regarding privacy matters if such cashless systems were to be universally adopted.

Resistance to a cashless society has also been voiced by individuals who would prefer a return to specie coinage. Mexico tried to unsuccessfully re-introduce a partial silver coinage during the 1990s. The terrorist organization ISIS has more recently attempted to force gold coins into circulation, also unsuccessfully.

In 1965 when U.S. Congress was debating the issue of specie coinage Nevada Representative Walter S. Baring said, “I would rather eat with chopsticks than take the silver out of our coinage,” upon learning the U.S. Treasury was selling stockpiled silver to cutlery manufacturers. Representative Harold Gross of Iowa chimed in, asking if perhaps the U.S. should revert to using wampum.

This article was originally printed in World Coin News. >> Subscribe today.

More Collecting Resources

• Liked this article? Read more by subscribing to Numismatic News.

• Check out the newly-updated Standard Catalog of World Coins, 2001-Date that provides accurate identification, listing and pricing information for the latest coin releases.