Norway Moves Cashless

Norges Bank, the central bank of Norway, recently reported it calculated Norwegians are using coins and bank notes for about three to four percent of their financial transactions. This makes…

Norges Bank, the central bank of Norway, recently reported it calculated Norwegians are using coins and bank notes for about three to four percent of their financial transactions. This makes Norway the most cashless society in the world, ahead of neighboring Sweden.

While cashless society proponents may be celebrating, the central banks in these two Scandinavian countries are not. According to an April 23 Bloomberg News report, this situation has “sounded the alarm amid concerns that the complete disappearance of paper money would pose a number of risks.”

Ida Wolden Bache is the executive director for monetary policy and vice president at Norges Bank. On November 11, 2020 Bache said, “Only four percent of payments are now made using cash. This share is approximately the same as in spring, and considerably lower than before the [Coronavirus] pandemic.”

Bach added, “To our knowledge, the share of cash payments is lower in Norway than in any other country.”

Bache said, “Three out of every four card payments are now contactless payments…An increasing number of smartphone apps can be used to make payments in shops. Online shopping is growing, and payment is increasingly made via smartphone apps and other digital wallets.”

On April 23 Bache told Bloomberg, “Cash serves important functions in the payment system and so we take measures to make sure it is still accessible and available.” She continued that there are no plans to “abolish or stop supplying cash,” if a central bank digital currency were to be introduced. In fact, Norway’s watchdog group has until September 3 to respond to the Finance Ministry’s concerns about the future availability of physical cash. She continued, “Some companies such as Amazon, Apple, and Facebook also control shopping and social network platforms, often offering services on the platform in competition with other operators. There is a risk that users will be locked in and that the range of payment options will be reduced over time.”

“The payments market is characterized by scale and network advantages. We must therefore be vigilant to developments whereby some operators – domestic or global – gain market power that weakens competition.”

The Norwegian Finance Ministry recently released a statement indicating “There is a need to clarify individual banks’ duty to give customers the opportunity to deposit and withdraw cash.” The Finance Ministry statement comes in the wake of a number of Norwegian banks that “claim that they are not responsible for offering cash services.”

Sweden also grapples with what to do as the demand for physical cash declines dramatically. In Sweden, laws were recently imposed requiring the larger banks to provide cash services. The Swedish central bank is tripling the number of offices available to handle bank notes and coins.

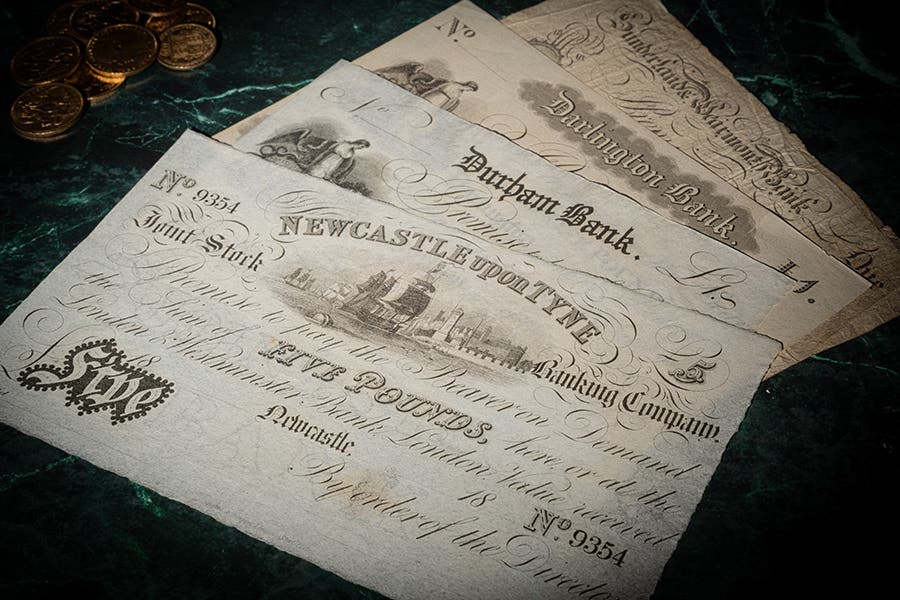

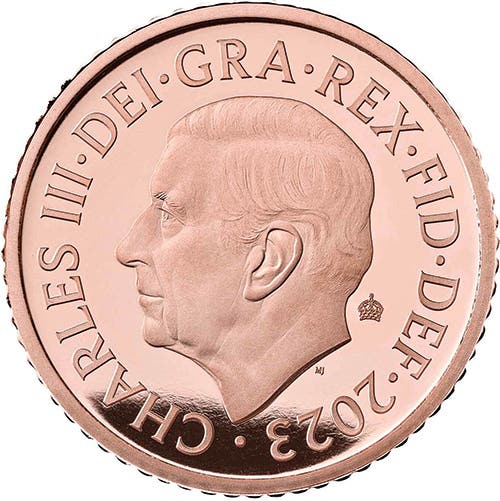

The Mint of Norway was founded in 1686, making it the nation’s second longest established manufacturing facility. Samlerhuser Group purchased 50 percent interest in the mint in 2003. The other 50 percent was purchased by the Mint of Finland, but Samlerhuser later purchased the Mint of Finland’s interests. Today the Mint of Norway strikes all Norwegian legal tender coins as well as coins for several other nations.

The ramifications of a country going completely cashless are increasingly needing to be addressed globally. As well-known numismatic publicist Donn Pearlman put it, “When the Tooth Fairy visits, will children find a MasterCard under their pillows?” Pearlman neglected to mention the penny loafer becoming the American Express loafer. This is no fairy tale.