Goodbye to 1 and 2 Cent Coins?

More Euro countries are introducing rounding rules.

The European Union has decided to impose a cash payment limit. Starting in 2027, cash transactions over €10,000 will be banned across Europe, although individual countries can set lower limits if they choose. Many euro countries are actively working on their own measures to reduce cash usage.

One small and inconspicuous Euro country, Estonia, is demonstrating how this can be done. Estonia, one of the States on the Baltic Sea, regained its independence following the collapse of the Soviet Union and introduced its own currency, the “Kroon.” Estonians cherished their currency and reluctantly adopted the euro in 2011. They’ve gotten used to the euro since then, but soon, they may need to say goodbye once again.

Small Coins Get Phased Out in an Offhand Remark

In a May 2024 report on cash circulation, Estonia's central bank, "Eesti Pank," casually mentioned: "The Parliament is in the process of passing a law to introduce rounding rules for 1 and 2-cent coins to reduce their usage." The central bank explained, "The rounding rules would mean that the total price at checkout would be rounded to the nearest five cents, but only for cash payments." These new regulations from Estonia's Parliament ("Riigikogu") are set to take effect on Jan. 1, 2025.

A similar development occurred in another Baltic state in spring 2024. In April, the Lithuanian Parliament ("Seimas") passed a law that introduced the following rounding rules: If the final price ends in 1, 2, 6, or 7 cents, it will be rounded down to the nearest 5 cents. If it ends in 3, 4, 8, or 9 cents, it will be rounded up. This law will take effect on May 1, 2025.

A Move Toward Eliminating Small Coins

While the decisions of these small Baltic republics might seem insignificant, they represent another step toward phasing out small cent coins, which are integral to daily cash transactions. More and more countries are opting out of producing small-cent coins, including the Netherlands, Italy, Ireland, Finland, and Belgium. A 2018 report from the European Commission notes: "The minting cost of 1-cent coins generally exceeds their face value." Are 1 and 2-cent coins soon to become relics of the past?

Phasing Out Cent Coins for Environmental Reasons?

Like the broader cash limit, there is also a politically correct reason for eliminating small-cent coins that few can argue against. While the cash limit aims to combat crime, the end of 1- and 2-cent coins is considered an environmental measure: "They are costly to produce and handle and have a significant environmental impact," says "Eesti Pank." "They don’t buy much and are rarely used for payments, so they tend to remain unused and don't circulate." The most important point is that implementing the rounding rule would mean no new 1- and 2-cent coins would need to be produced.

Potential Impact of Eliminating Small Coins

Even though Estonia's central bank makes a strong case, the elimination of small cent coins could have significant effects, such as increasing inflation. Rounding up at the checkout could raise shopping costs. Although "Eesti Pank" notes that prices will be rounded to the nearest five cents, both up and down, economists predict the new rounding rules will lead to higher consumer costs, echoing the German version of the popular saying "Many pennies make a dollar.”

More Countries Moving Away from Small Change

The debate over removing small coins from daily transactions is ongoing in many countries. When the Euro was introduced, Finland implemented mandatory rounding to the nearest five cents for cash payments. Similar rules were adopted in the Netherlands in 2004, Belgium in 2014, Ireland in 2015, and Italy in 2017. The decline in small-cent coin usage is evident in minting figures: Belgium last minted 1-cent coins for circulation in 2017 and 2-cent coins in 2016. Italy has only minted 5-cent coins since 2017, foregoing new 1- and 2-cent coins.

Arguments for Keeping Small Denominations

Despite the push for their elimination, there are strong reasons to keep these coins:

- Price Accuracy and Consumer Protection: Small coins allow for precise pricing. Without them, prices may be systematically rounded, often disadvantaging consumers. Retailers might round up prices, leading to disproportionate price increases for low-cost items.

- Psychological Impact: Prices just below a whole number (e.g., €0.99) are perceived as cheaper than rounded prices. The removal of small coins would affect this marketing strategy.

- Charity and Donations: Small coins play a role in charitable giving. Many people donate small change, which adds up significantly. Eliminating these coins could reduce small but meaningful contributions.

- Cash-Dependent Groups: Certain groups, including the elderly, children, and those without bank accounts, rely more on cash. Small coins help them conduct precise transactions and manage their finances.

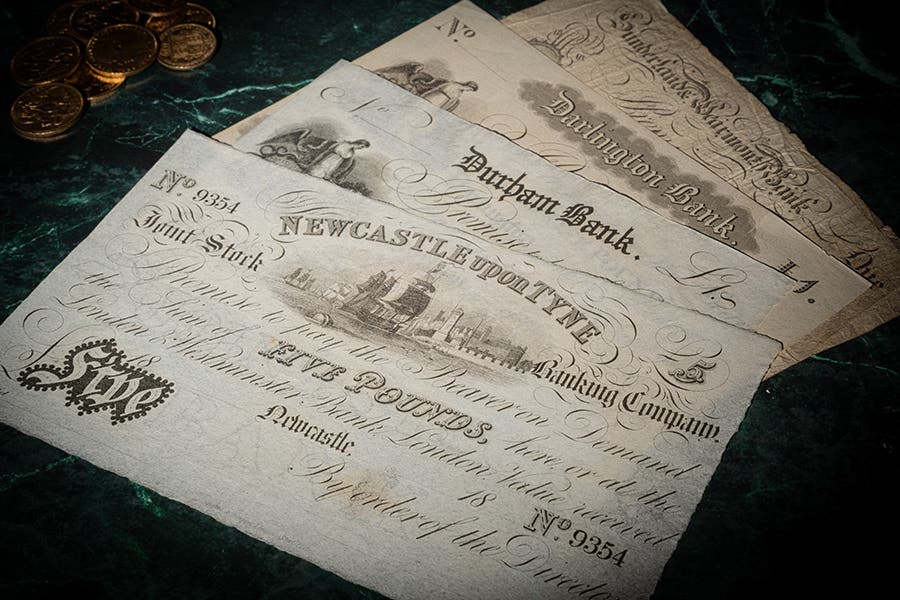

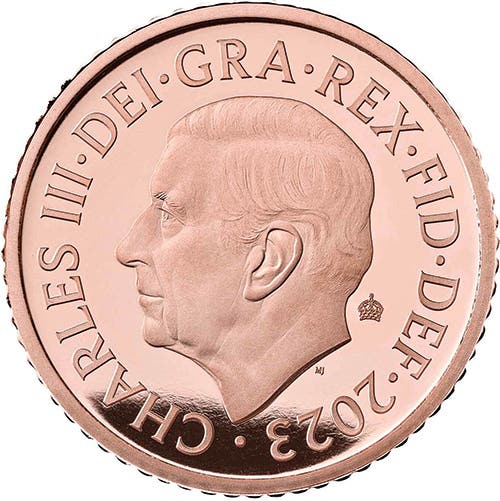

- Cultural and Historical Value: Coins are not just currency but also cultural artifacts with historical and national symbols. They contribute to national identity and serve as keepsakes or collectibles.

- Economic Stability in Crises: Cash, including small coins, is a reliable payment method during economic uncertainty or electronic payment system failures. Having all denominations ensures smooth transactions.

- Small-cent coins may seem trivial to some, but they are a fundamental part of many Europeans' financial freedom. Despite their low purchasing power and associated costs, they offer practical, psychological, social, and cultural benefits. Eliminating them could have far-reaching effects beyond mere cost savings, and many Europeans fear that the removal of 1- and 2-cent coins is just the beginning.

You may also like: