Changes Coming to Our Change?

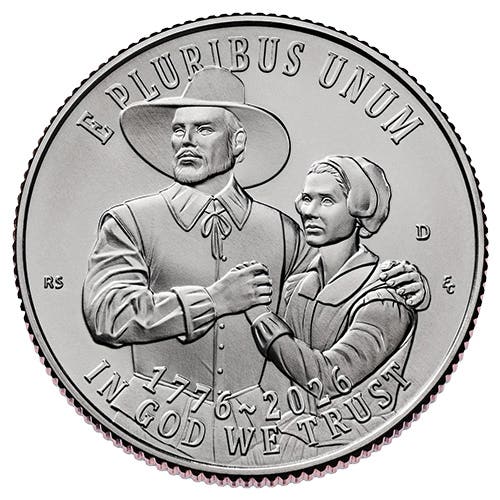

New Coin Metal Modification Authorization and Cost Savings Act is presented to Congress creating a new change in the metal content of circulation coins as a cost saving measure.

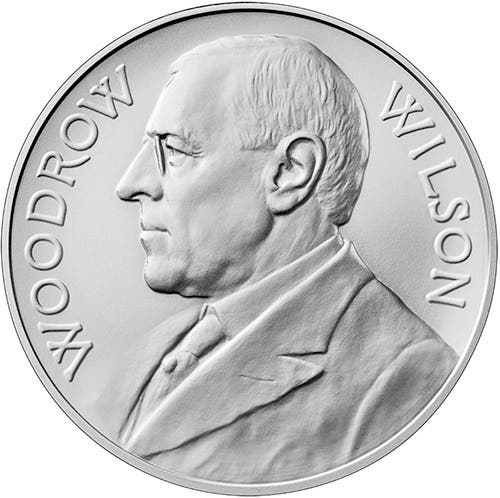

Changes to our change may be good news not only for the public, but for collectors as well. Senators Joni Ernst (R-Iowa) and Maggie Hassan (D-NH) have introduced the Coin Metal Modification Authorization and Cost Savings Act in Congress. Their objective is to allow the Mint to alter the metal content of circulation coins as a cost saving measure. It’s no secret that, due to the inflated price of many metals, it costs more than face value to produce our business strike coinage.

Should this bill become law, collectors may see a repeat of the 1982 scenario where there were several different seemingly alike Lincoln cents to be collected due to mid-year changes in metal composition. Should the mint be given this option, the results could be off-metal errors and varieties. Even better news is this could encourage the non-collecting public to examine their change and perhaps become collectors.

While we watch to see what Congress may or may not do, the current market continues to draw a lot of attention from well-financed and serious collectors as well as investors recognizing coins as an asset class and important alternative to a very rocky stock market. Gold and silver continue to trade in a narrow range, gold near the psychological $2,000 an ounce region and silver at about $25 an ounce.

Rare coins not available for years continue to be liquidated from older collections and are being offered at auctions. The number of bidders at auctions, both online and at public venues, continues to climb. The current market for coins still has legs, and these legs keep moving along at a near record pace.