Bullion Production Limitations

Demand for physical precious metal coins and ingots has been strong for most of the past year. With governments around the world taking actions to reduce the purchasing power of…

Demand for physical precious metal coins and ingots has been strong for most of the past year. With governments around the world taking actions to reduce the purchasing power of their fiat (paper) currencies, it is likely that demand will continue strong for the indefinite future.

So, given that demand is so strong, why is it so difficult to ramp up production of coins and ingots?

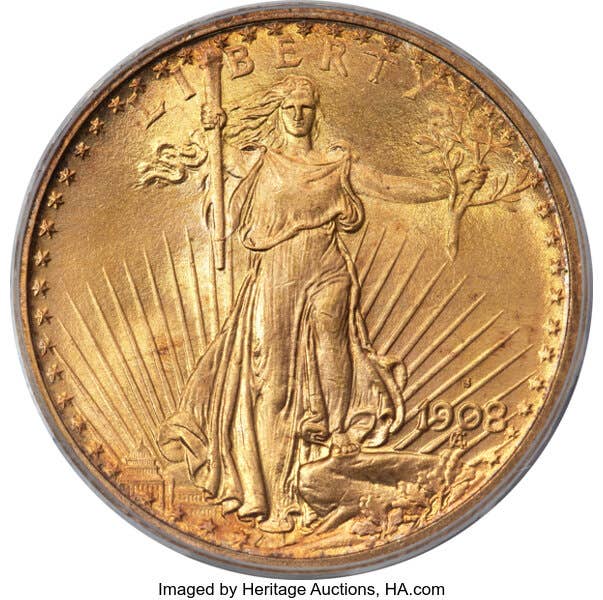

Some might wonder about the difficulty of procuring the physical metals used to strike the coins. This can have some temporary effects, but it is not as important as another issue.

Instead, I suspect that a major obstacle to ramping up production has to do with the extremely small profit margins earned by fabricators of these products. In the late 1980s, Engelhard Corporation elected to discontinue its entire production of bullion bars simply because of razor-thin profits. Instead, the company elected to focus on chemical catalysts, a product line with far higher margins.

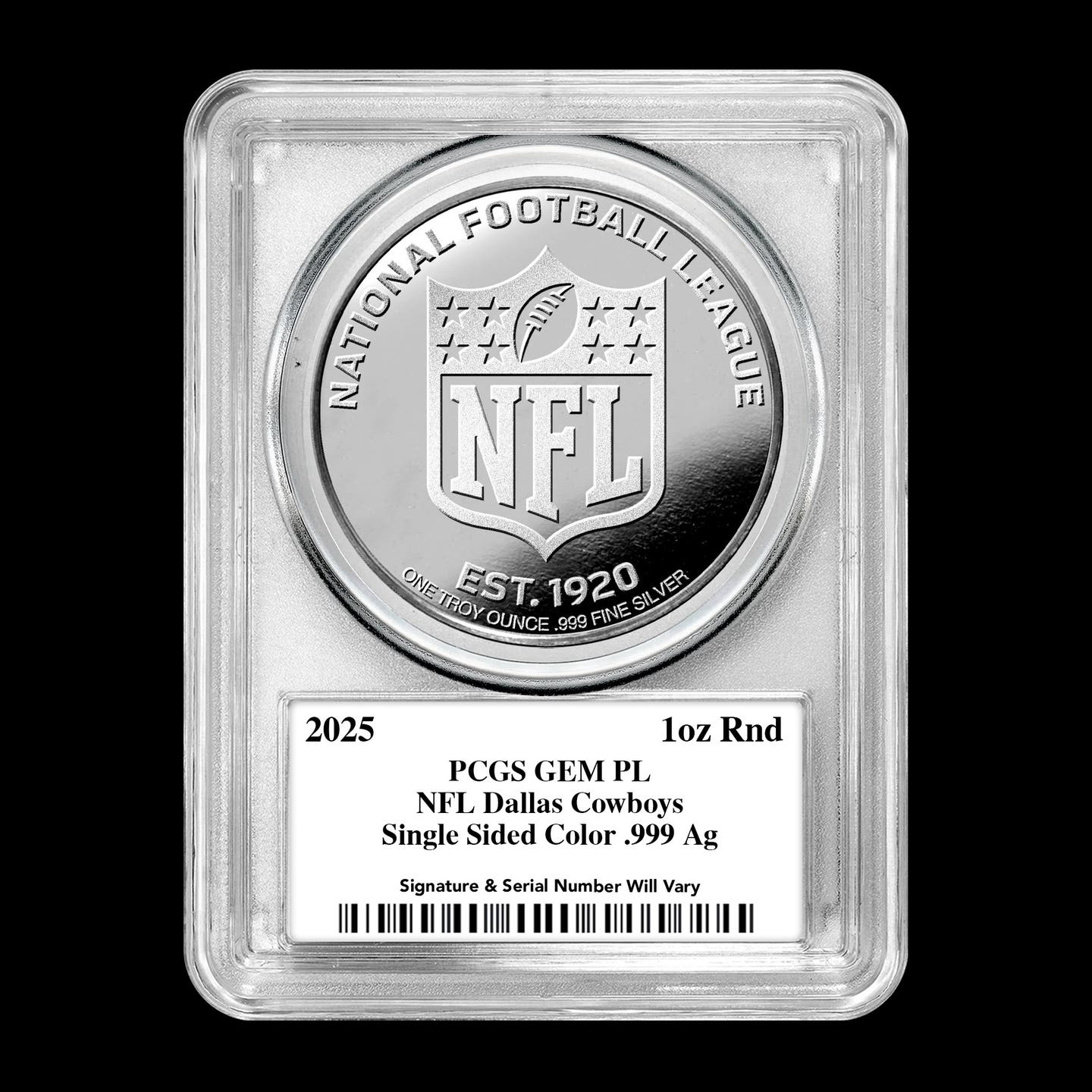

Upon the introduction of the American Eagle gold and silver coins, the U.S. Mint fabricated at least part of the coin planchets for these issues. Years later it stopped doing so, going to outside vendors.

Mint officials explained that part of the in-house production problem was the variability in demand for these products. It was difficult to efficiently keep in-house the equipment and personnel capacity to produce sufficient planchets in boom times, yet be able to switch machines and people to other purposes when demand was much less. For the silver Eagle dollars, for instance, the U.S. Mint then signed contracts with outside planchet suppliers such as the Perth Mint and Sunshine Minting.

Going to outside vendors for coin blanks did not cure the problem of obtaining sufficient supplies during times of high demand. The suppliers also happen to issue their own products in competition with the U.S. Mint or they also have contracts to supply planchets to other competitors. During one time of high demand, officials at the Perth Mint reported that they could have used their entire production capability striking coins and bars for their own products, but that it had made a minimum commitment to the U.S. Mint to provide silver Eagle planchets. As a result, neither the Perth Mint nor the U.S. Mint could obtain sufficient planchets to meet immediate demand.

Over the past 10 months, the impact of the COVID-19 pandemic and the economic lock-downs imposed on production have resulted in temporary supply disruptions. However, I believe that the much larger problem in meeting strong demand for physical precious metals has to do with the small profit margins earned by fabricators. This is not a problem with a practical solution.

Incidentally, the U.S. Mint also faces other production limitations with circulating coinage. Toward the end of a year, the Federal Reserve sends to the Mint an estimate of the quantity of each denomination of circulating coins it will require in the next calendar year. To maximize efficiency of equipment and staff, the Mint then schedules production of these coins about equally throughout the course of the year.

If an event develops to disrupt other circulating coin sources or to spark higher demand, the Mint is unable to instantly ramp up fabrication levels. This occurred in 2020 when many bank and credit union lobbies were closed to the public for a time. For meeting circulating coin needs, the Federal Reserve Bank projected how much coinage the public would turn in to financial institutions in 2020, which they could not do when lobbies were closed. Consequently, a shortage of circulating coinage developed in mid-2020, where the U.S. Mint needed at least six months to increase production levels.

Patrick A. Heller was honored as a 2019 FUN Numismatic Ambassador. He is also the recipient of the American Numismatic Association 2018 Glenn Smedley Memorial Service Award, 2017 Exemplary Service Award, 2012 Harry Forman National Dealer of the Year Award and 2008 Presidential Award. Over the years, he has also been honored by the Numismatic Literary Guild (including twice in 2020), Professional Numismatists Guild, Industry Council for Tangible Assets, and the Michigan State Numismatic Society.